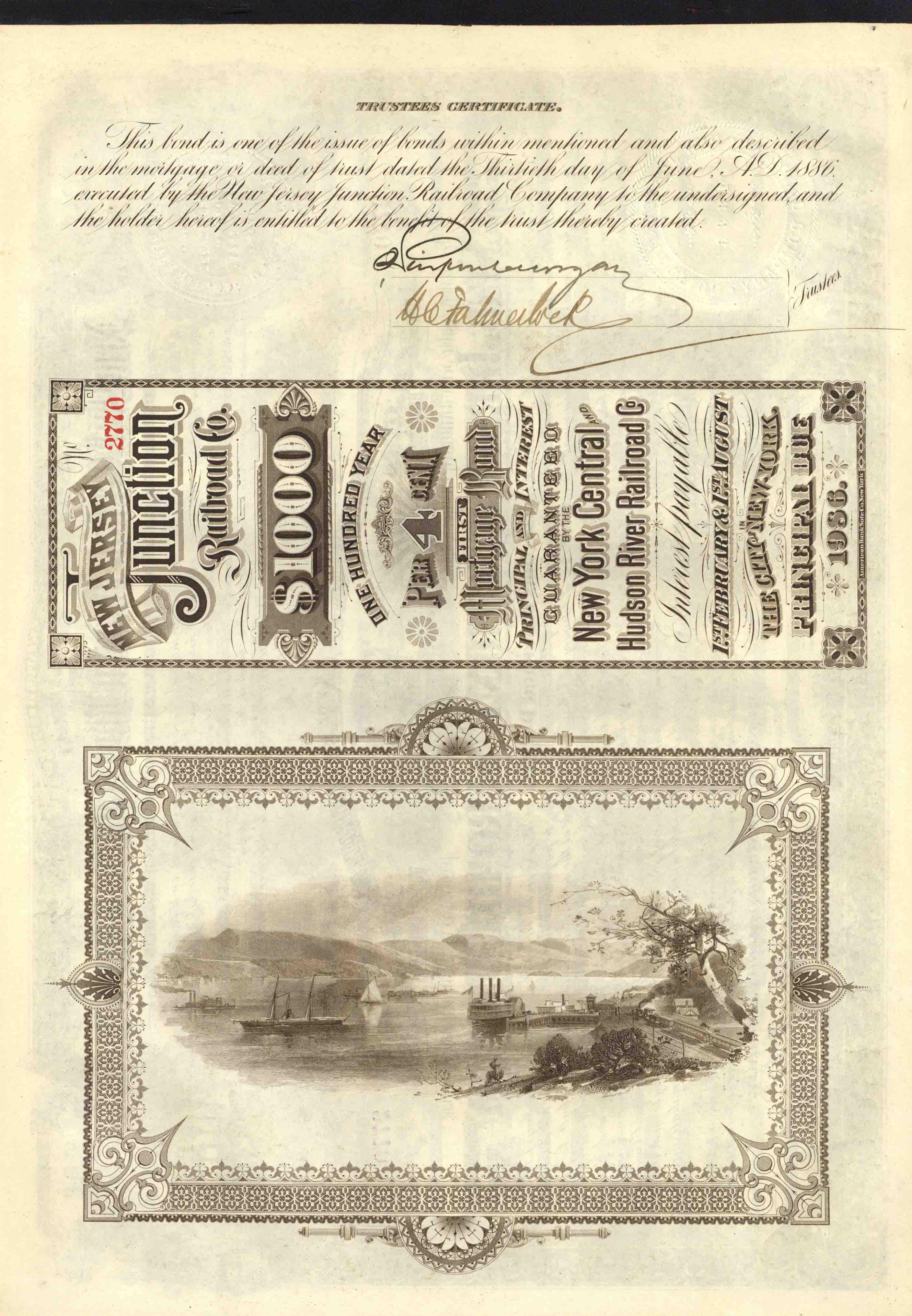

J. Pierpont Morgan signed New Jersey Junction Railroad - 1886 dated Uncanceled Bond signed also by Harris Charles Fahnestock - 100 Year Autograph Railroad Bond!

Inv# AG1016 Bond

The New Jersey Junction Railroad (NJJ) was a subsidiary of the New York Central Railroad (NYCRR) that operated along the Hudson River in Hudson County, New Jersey. The line extended from the West Shore Railroad yards at the Weehawken Terminal down to Jersey City. An additional extension to the north, separated by the Weehawken yard, was later included in its operations.

The company was incorporated under New Jersey state law on February 27, 1886, and soon after, on July 1, 1886, it was leased for 100 years to the New York Central and Hudson River Railroad. The line opened for freight service in May 1887, followed by passenger service in June 1887, playing a crucial role in connecting the industrial areas along the Hudson River to the larger New York Central Railroad network.

Harris Charles Fahnestock (February 27, 1835 – June 4, 1914) was an American investment banker who played a significant role in the financial landscape during and after the Civil War. In 1861, Fahnestock became a partner in the prominent banking firm Jay Cooke & Company, based in Washington, D.C., where he garnered attention for his involvement in negotiating substantial war loans to support the Union during the Civil War.

While in Washington, Fahnestock developed an interest in the burgeoning railroad industry, serving as treasurer of the Washington & Georgetown Line. In 1866, he relocated to New York City to join Jay Cooke, McCulloch & Co., a new firm formed with Jay Cooke and Hugh McCulloch, the former Comptroller of the Currency under President Lincoln. Fahnestock remained with the firm until its collapse during the Panic of 1873, a financial crisis that led to a severe economic depression in the United States.

John Pierpont Morgan (April 17, 1837 – March 31, 1913) was a prominent American financier, banker, and industrial consolidator who played a crucial role in shaping the U.S. economy during the Gilded Age and early 20th century. Known for his powerful influence in finance and corporate management, Morgan was a key figure in reorganizing and consolidating several major industries, including steel, railroads, and electricity.

Morgan founded J.P. Morgan & Co., a major banking institution, and was instrumental in forming the U.S. Steel Corporation in 1901 by merging several steel companies, including the Carnegie Steel Company. This merger created the world’s first billion-dollar corporation and marked the peak of Morgan's influence in American industry. He also played a pivotal role in the creation of General Electric and International Harvester, overseeing mergers and acquisitions that shaped the corporate landscape of the time.

Morgan's financial acumen was critical during several economic crises, such as the Panic of 1907, where he organized a coalition of bankers to stabilize the American economy. He was a key figure in promoting the establishment of the Federal Reserve System, which aimed to prevent future financial crises.

Beyond his business endeavors, J.P. Morgan was a notable philanthropist and collector of art, manuscripts, and rare books. His legacy endures in both the financial world and the arts, with institutions like the J.P. Morgan Library and Museum in New York City continuing to honor his contributions.

A bond is a document of title for a loan. Bonds are issued, not only by businesses, but also by national, state or city governments, or other public bodies, or sometimes by individuals. Bonds are a loan to the company or other body. They are normally repayable within a stated period of time. Bonds earn interest at a fixed rate, which must usually be paid by the undertaking regardless of its financial results. A bondholder is a creditor of the undertaking.

Ebay ID: labarre_galleries