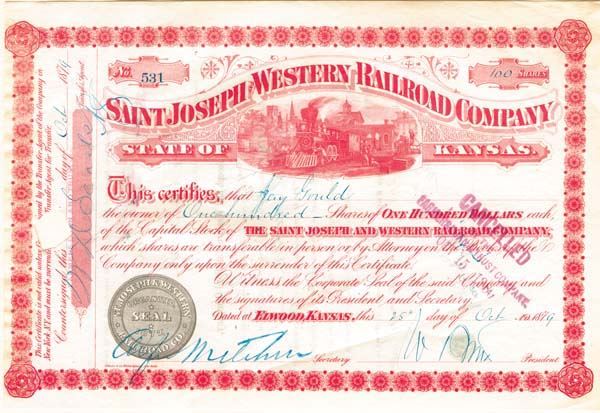

Jay Gould - Saint Joseph and Western Railroad Co. - Signed Stock Certificate

Inv# AG1289 Stock

Capital Stock, issued from Elwood, Kansas to Jay Gould (1836-1892) Financier. The St. Joseph and Western was originally chartered in 1857 as the Marysville, Palmetto and Roseport RR Company with its name being changed to the St. Joseph and Denver City RR in 1862. The line extended a distance of 252 miles from St. Joseph, Kansas to Grand Island, Nebraska connecting these two important mid-western America trade centers. The company went into receivership in 1874 and sold in foreclosure in November of 1875. ln 1879, (the year of this stock certificate now offered), the road came under the control of the Union Pacific Railway Company which owned a large portion of the company's stocks and bonds. It thus operated as the St. Joseph and Western Division of the Union Pacific with Jay Gould, Russell Sage, and Sidney Dillon all serving as directors of the company.

Acquisition of the Saint Joseph and Western RR was part of Gould's strategy to compete with the Union Pacific. He acquired it for his Wabash system as a weapon against the Iowa pool, a system of price agreements among the would be direct competitors of Jay Gould.

Gould forced the Union Pacific to buy him out via a stock swap. He got UP stock of great value in exchange. He made something in the neighborhood of $7,000,000 on the deal. By 1890 he owned half of the railroad mileage in the Southwest. This stock is one of the most historic, colorful, and graphic of any signed by Jay Gould.

Jason Gould (May 27, 1836 – December 2, 1892) was an American railroad magnate and financial speculator who is generally identified as one of the robber barons of the Gilded Age. His sharp and often unscrupulous business practices made him one of the wealthiest men of the late nineteenth century. A highly controversial and unpopular figure during his life; Gould is widely regarded as one of the great villains of his era. As of 2019, he is the progenitor of five generations of the Gould family of financiers, philanthropists, and diplomats.

Gould was born in Roxbury, New York, to Mary More (1798–1841) and John Burr Gould (1792–1866). His maternal grandfather Alexander T. More was a businessman, and his great-grandfather John More was a Scottish immigrant who founded the town of Moresville, New York. Gould studied at the Hobart Academy in Hobart, New York. As a young boy, he decided that he wanted nothing to do with farming, his father's profession, so his father dropped him off at a nearby school with 50 cents and a sack of clothes.

Gould's school principal was credited with getting him a job as a bookkeeper for a blacksmith. A year later, the blacksmith offered him half interest in the blacksmith shop, which he sold to his father during the early part of 1854. Gould devoted himself to private study, emphasizing surveying and mathematics. In 1854, he surveyed and created maps of the Ulster County, New York, area. In 1856, he published History of Delaware County, and Border Wars of New York, which he had spent several years writing.

In 1856, Gould entered a partnership with Zadock Pratt to create a tanning business in Pennsylvania in an area that was later named Gouldsboro. He eventually bought out Pratt, who retired. In 1856, Gould entered a partnership with Charles Mortimer Leupp, a son-in-law of Gideon Lee and one of the leading leather merchants in the United States, and it was a successful partnership until the Panic of 1857. Leupp lost all his money in that financial crisis, but Gould took advantage of the depreciation in property value and bought up former partnership properties.

The Gouldsboro Tannery became a disputed property after Leupp's death. Leupp's brother-in-law David W. Lee was also a partner in Leupp and Gould, and he took armed control of the tannery. He believed that Gould had cheated the Leupp and Lee families in the collapse of the business. Gould eventually took physical possession, but he was later forced to sell his shares in the company to Lee's brother.

In 1859, Gould began speculative investing by buying stock in small railways. His father-in-law Daniel S. Miller introduced him to the railroad industry by suggesting that Gould help him save his investment in the Rutland and Washington Railroad in the Panic of 1857. Gould purchased stock for 10 cents on the dollar, which left him in control of the company. He engaged in more speculation on railroad stocks in New York City throughout the Civil War, and he was appointed manager of the Rensselaer and Saratoga Railroad in 1863.

The Erie Railroad encountered financial troubles in the 1850s, despite receiving loans from financiers Cornelius Vanderbilt and Daniel Drew. It entered receivership in 1859 and was reorganized as the Erie Railway. Gould, Drew, and James Fisk engaged in stock manipulations known as the Erie War, and Drew, Fisk, and Vanderbilt lost control of the Erie in the summer of 1868, while Gould became its president.

It was during the same period that Gould and Fisk became involved with Tammany Hall, the Democratic Party political machine that largely ran New York City at the time. They made its boss, William "Marcy" Tweed, a director of the Erie Railroad, and Tweed arranged favorable legislation. Tweed and Gould became the subjects of political cartoons by Thomas Nast in 1869. Gould was the chief bondsman in October 1871 when Tweed was held on $1 million bail. Tweed was eventually convicted of corruption and died in jail.

In August 1869, Gould and Fisk began to buy gold in an attempt to corner the market, hoping that the increase in the price of gold would increase the price of wheat and motivate western farmers to sell. This, in turn, would cause a great amount of shipping eastward, increasing freight business for the Erie Railroad. During this time, Gould used contacts with President Ulysses S. Grant's brother-in-law Abel Corbin to influence the president and his Secretary General Horace Porter. These speculations culminated in the panic of Black Friday on September 24, 1869, when the premium over face value fell on a gold Double Eagle from 62 percent to 35 percent. Gould made a small profit from this operation by hedging against his own attempted corner as it was about to collapse, but he lost it in subsequent lawsuits. The gold corner established Gould's reputation in the press as an all-powerful figure who could drive the market up and down at will.

In 1873, Gould attempted to take control of the Erie Railroad by recruiting foreign investments from Lord Gordon-Gordon, supposedly a cousin of the wealthy Campbell clan who was buying land for immigrants. He bribed Gordon-Gordon with a million dollars in stock, but Gordon-Gordon was an impostor and cashed the stock immediately. Gould sued him, and the case went to trial in March 1873. In court, Gordon-Gordon gave the names of the Europeans whom he claimed to represent, and he was granted bail while the references were checked. He immediately fled to Canada, where he convinced authorities that the charges were false.

Gould failed to convince Canadian authorities to hand over Gordon-Gordon, so he attempted to kidnap him with the help of his associates and future members of Congress Loren Fletcher, John Gilfillan, and Eugene McLanahan Wilson. The group captured him successfully, but they were stopped and arrested by the North-West Mounted Police before they could return to the US. Canadian authorities put them in prison and refused them bail, and this led to an international incident between the United States and Canada. Governor Horace Austin of Minnesota demanded their return when he learned that they had been denied bail, and he put the local militia on full readiness, and thousands of Minnesotans volunteered for an invasion of Canada. After negotiations, the Canadian authorities released them on bail. Gordon-Gordon was eventually ordered to be deported but committed suicide before the order could be carried out.

After being forced out of the Erie Railroad, Gould started to build up a system of railroads in the midwest and west. He took control of the Union Pacific in 1873 when its stock was depressed by the Panic of 1873, and he built a viable railroad that depended on shipments from farmers and ranchers. He immersed himself in every operational and financial detail of the Union Pacific system, building an encyclopedic knowledge and acting decisively to shape its destiny. Biographer Maury Klein states that "he revised its financial structure, waged its competitive struggles, captained its political battles, revamped its administration, formulated its rate policies, and promoted the development of resources along its lines."

By 1879, Gould gained control of three more important western railroads, including the Missouri Pacific Railroad. He controlled 10,000 miles (16,000 km) of railway, about one-ninth of the rail in the United States at that time, and he had controlling interest in 15 percent of the country's railway tracks by 1882. The railroads were making profits and set their own rates, and his wealth increased dramatically. He withdrew from management of the Union Pacific in 1883 amid political controversy over its debts to the federal government, but he realized a large profit for himself. He obtained a controlling interest in the Western Union telegraph company and in the elevated railways in New York City after 1881. In 1889, he organized the Terminal Railroad Association of St. Louis which acquired a bottleneck in east-west railroad traffic at St. Louis, but the government brought an antitrust suit to eliminate the bottleneck control after Gould died.

A stock certificate is issued by businesses, usually companies. A stock is part of the permanent finance of a business. Normally, they are never repaid, and the investor can recover his/her money only by selling to another investor. Most stocks, or also called shares, earn dividends, at the business's discretion, depending on how well it has traded. A stockholder or shareholder is a part-owner of the business that issued the stock certificates.

Ebay ID: labarre_galleries