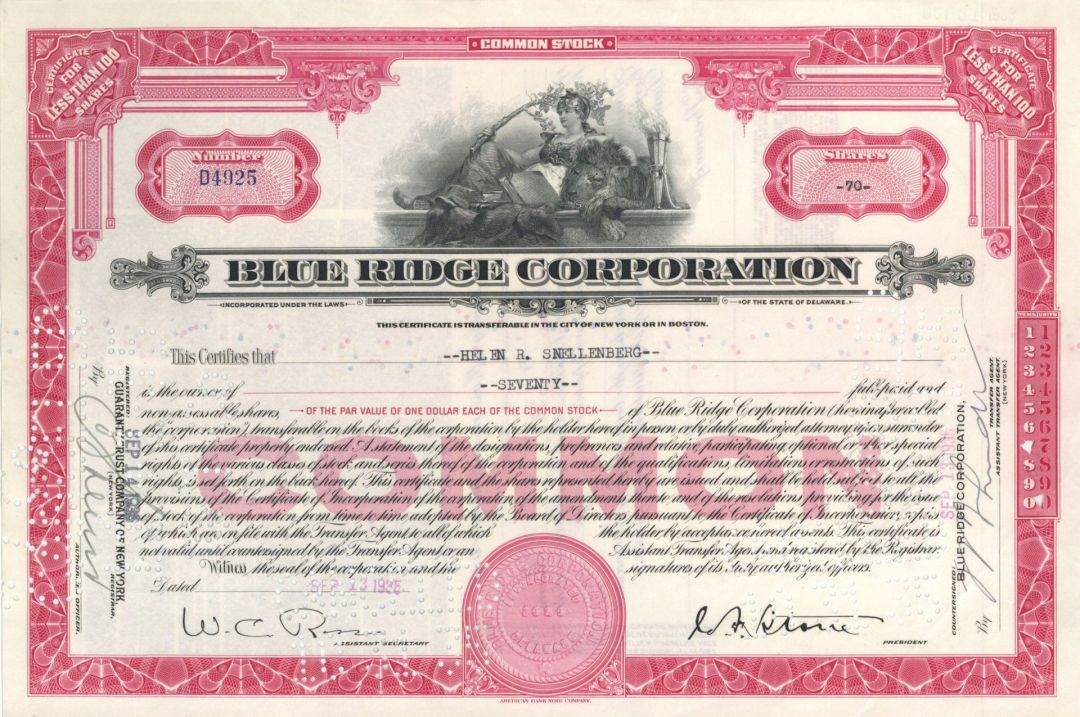

Blue Ridge Corp. - 1930's-40's dated Stock Certificate - Goldman Hiding Behind Goldman - Great History

Inv# GS1056 StockMassachusetts

New York

General Stock.. Great vignette of female figure sitting with lion. Elaborate engraved border. American Bank Note Co. Available in Red, Blue, Orange or Purple. Please specify color.

In December 1928, Goldman, Sachs and Company established the Goldman Sachs Trading Corporation. This entity sold securities to the public while retaining sufficient common stock to maintain control. The bank issued one million shares at a price of $100 each, purchased all of these shares with its own capital, and subsequently sold 90 percent of them to eager investors at $104. The trading corporation then persistently acquired shares of its own stock, driving the price upward. Eventually, it liquidated a portion of its holdings and initiated a new trust, the Shenandoah Corporation, which issued millions of additional shares. This trust subsequently facilitated the creation of another trust known as the Blue Ridge Corporation.

Thus, each investment trust functioned as a facade for an ongoing investment pyramid, with Goldman concealed behind successive layers of Goldman entities. Out of the 7,250,000 initial shares of Blue Ridge, 6,250,000 were effectively owned by Shenandoah, which was predominantly owned by Goldman Trading. In the following July, the trading corporation, in collaboration with Harrison Williams, launched the Shenandoah Corporation. Similar to previous ventures, securities were sold to the public while a controlling interest remained with the trading corporation. Subsequently, in the final days of the market boom, Shenandoah established the Blue Ridge Corporation, which was sold in 1936. Read more at https://www.nytimes.com/1929/08/20/archives/127000000-trust-by-goldman-sachs-blue-ridge-corporation-formed-by.html

A stock certificate is issued by businesses, usually companies. A stock is part of the permanent finance of a business. Normally, they are never repaid, and the investor can recover his/her money only by selling to another investor. Most stocks, or also called shares, earn dividends, at the business's discretion, depending on how well it has traded. A stockholder or shareholder is a part-owner of the business that issued the stock certificates.

Ebay ID: labarre_galleries