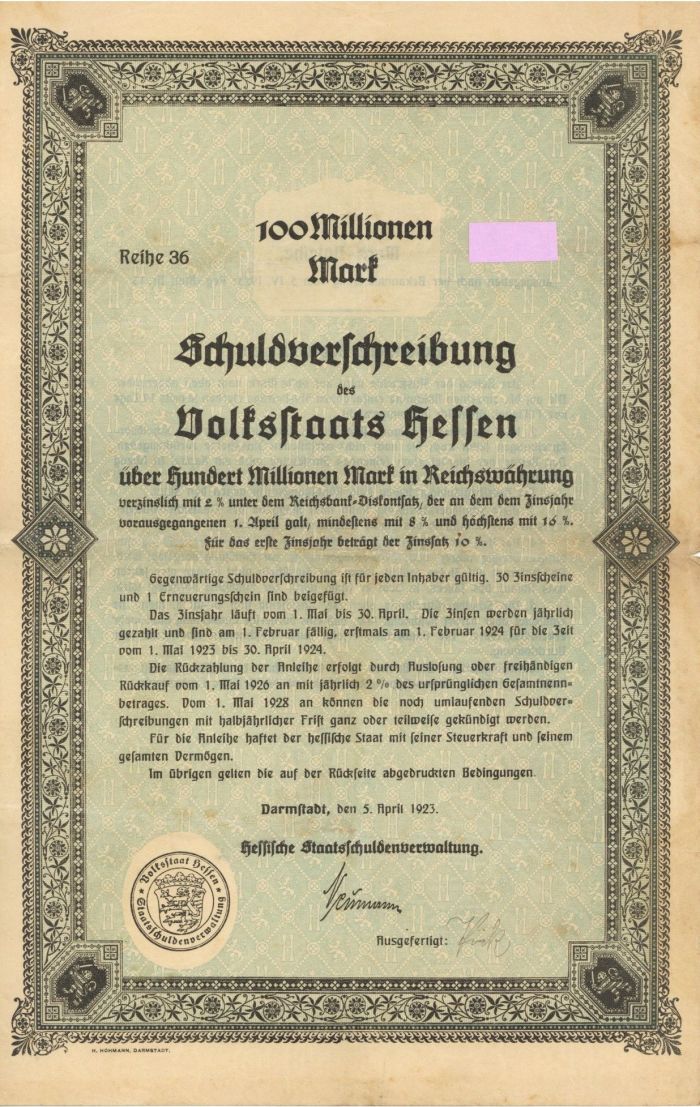

100 Million German Marks - German Bond

Inv# FB6666 Bond

100 Million German Marks 2% Bond with 2 full pages of coupons.

The Deutsche Mark was the official currency of West Germany from 1948 until 1990 and later the unified Germany from 1990 until the adoption of the euro in 2002. In English, it is commonly called the "Deutschmark" (/ˈdɔɪtʃmɑːrk/); this expression is unknown in Germany. One Deutsche Mark was divided into 100 pfennigs.

It was first issued under Allied occupation in 1948 to replace the Reichsmark and served as the Federal Republic of Germany's official currency from its founding the following year. On 31 December 1998, the Council of the European Union fixed the irrevocable exchange rate, effective 1 January 1999, for German mark to euros as DM 1.95583 = €1. In 1999, the Deutsche Mark was replaced by the euro; its coins and banknotes remained in circulation, defined in terms of euros, until the introduction of euro notes and coins on 1 January 2002. The Deutsche Mark ceased to be legal tender immediately upon the introduction of the euro—in contrast to the other eurozone nations, where the euro and legacy currency circulated side by side for up to two months. Mark coins and banknotes continued to be accepted as valid forms of payment in Germany until 28 February 2002.

The Deutsche Bundesbank has guaranteed that all German marks in cash form may be changed into euros indefinitely, and one may do so in person at any branch of the Bundesbank in Germany. Banknotes and coins can even be sent to the Bundesbank by mail. In 2012, it was estimated that as many as 13.2 billion marks were in circulation, with one poll from 2011 showing a narrow majority of Germans favouring the currency's restoration (although only a minority believed this would bring any economic benefit).

A bond is a document of title for a loan. Bonds are issued, not only by businesses, but also by national, state or city governments, or other public bodies, or sometimes by individuals. Bonds are a loan to the company or other body. They are normally repayable within a stated period of time. Bonds earn interest at a fixed rate, which must usually be paid by the undertaking regardless of its financial results. A bondholder is a creditor of the undertaking.

Ebay ID: labarre_galleries