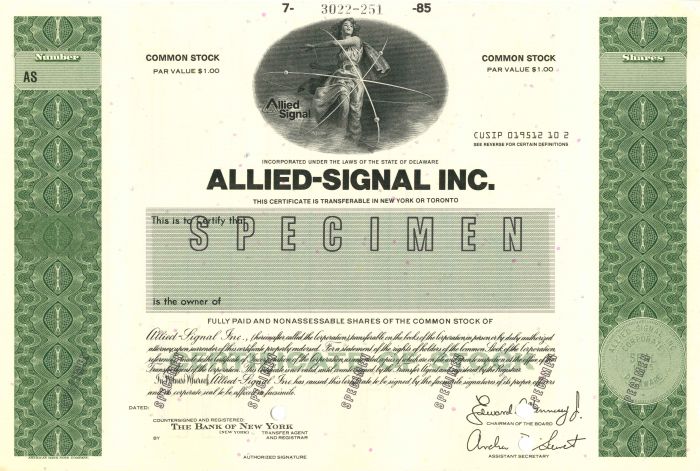

Allied-Signal Inc. - Stock Certificate

Inv# SE1889 Stock

Specimen Stock printed by American Bank Note Company.

AlliedSignal was an American aerospace, automotive and engineering company created through the 1985 merger of Allied Corp. and Signal Companies. It subsequently purchased Honeywell for $14.8 billion in 1999, who thereafter adopted the Honeywell name and identity.

AlliedSignal was a member of the Dow Jones Industrial Average from 1985 until February 19, 2008.

The Allied Chemical & Dye Corporation originated with the 1920 merger of five chemical companies: Barrett Paving Materials (est. 1852), General Chemical Company (est. 1899), National Aniline & Chemical Company (est. 1917), Semet-Solvay Company (est. 1895), and the Solvay Process Company (est. 1881). The consolidation occurred with the backing of chemist William Nichols, who became concerned about dependence on the German chemical industry during World War I, and financier Eugene Meyer. It acquired the Eltra Corporation in 1979.

The company renamed itself the Allied Chemical Corporation in 1958, then simply the Allied Corp. in 1981. Allied merged with the Bendix Corporation in 1983, beginning the company's involvement in aerospace.

The Signal Companies traced their history to the Signal Gasoline company, founded by Samuel B. Mosher in 1922. It renamed itself to Signal Gas & Oil in 1928 to reflect its expanding businesses; by the 1950s, Signal was the largest independent oil company on the West Coast of the United States and Mosher held large stakes in American President Lines and Flying Tiger Line. In 1964, Signal merged with the Garrett Corporation, an aerospace company, and the combined company adopted "The Signal Companies" as its corporate name in 1968.

The merger of Allied and Signal made aerospace the new company's largest business sector. The combined company adopted the name Allied-Signal on September 19, 1985. It dropped the hyphen to become AlliedSignal in 1993 to reinforce a one-company image and signify the full integration of all of its businesses. On June 7, 1999, AlliedSignal acquired Honeywell for $14.8 billion and took its more-recognizable name. The acquisition was meant as a final triumphant move to cap off a long career by AlliedSignal's CEO, Larry Bossidy.

Before the merger, Honeywell was an international controls company that developed and supplied advanced technology products, systems and services to aviation and space companies and industry. The product lines of the two companies were complementary, the only principal overlap being avionics.

- Aerospace

- Aircraft lighting

- Aircraft wheels & braking systems

- Auxiliary power units (APUs)

- Avionics

- Engines for regional/business aircraft

- Environmental control systems (ECS)

- Flight recorders (Black boxes)

- Jet engine fuel control systems

- Automotive products

- Autolite - Spark plugs

- Fram - air filters, fuel filters, oil filters

- Prestone - Antifreeze

- Garrett - turbochargers (formerly AiResearch)

- Engineered materials

- Electronic products

- Polymers

- Specialised chemicals

- Federal Manufacturing and Technology

- Operates facilities for the United States Department of Energy

As of 2006, Allied-Signal's automotive products included Fram Filters, Autolite Spark Plugs and Prestone Anti-Freeze. The Bendix Corporation had purchased both the Fram and Autolite brands from other companies in 1973. The Prestone brand was acquired in the late 1990s.

A stock certificate is issued by businesses, usually companies. A stock is part of the permanent finance of a business. Normally, they are never repaid, and the investor can recover his/her money only by selling to another investor. Most stocks, or also called shares, earn dividends, at the business's discretion, depending on how well it has traded. A stockholder or shareholder is a part-owner of the business that issued the stock certificates.

Ebay ID: labarre_galleries