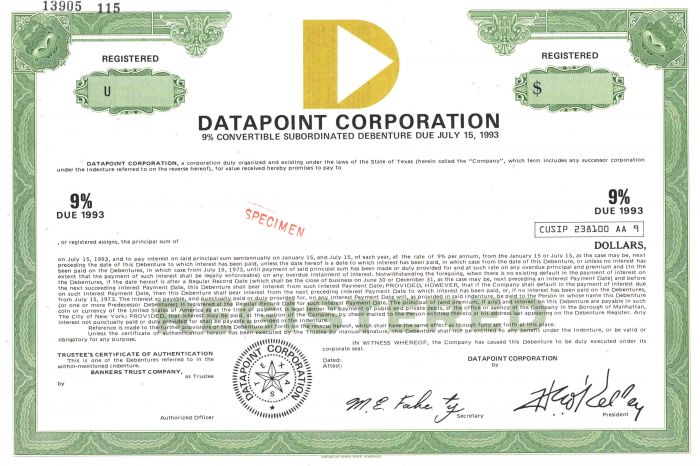

Datapoint Corporation Bond - Very Historic

Inv# SE1991 Bond

Green Specimen Bond printed by American Bank Note Company.

Datapoint Corporation, originally known as Computer Terminal Corporation (CTC), was a computer company based in San Antonio, Texas, United States. Founded in July 1968 by Phil Ray and Gus Roche, its first products were, as the company's initial name suggests, computer terminals intended to replace Teletype machines connected to time sharing systems.

From the mid-1960s, engineers (John) Phil Ray and Austin O. "Gus" Roche were working for General Dynamics Dynatronic Division in Florida, as part of a computing contract team for NASA to enable President John F. Kennedy's vision of putting a man on the moon. At the time, mainframe computers were large room-filling pieces of equipment, for which data was input using dumb and noisy Teletype terminals. On the advice of one of his tutors from the University of Texas, Ray and Roche decided to develop a quieter and smaller input device based on using a television set screen.

After finding San Antonio, Texas based backers, the pair incorporated Computer Terminal Corporation (CTC) there in July 1968. Based on a newly developed Texas Instruments chip, with a casing designed by an industrial designer in New York City, the company had developed three prototype Datapoint 3300 (deriving the name from the existing competitor Teletype Model 33), it was an immediate hit at that year's computer show.

However, the resultant orders left the company with several major problems: they had no production capacity, and no money with which to build a factory. Furthermore, the TI chips within the 3300 were so unreliable, they needed replacing every 30 minutes. In October 1969, the company raised US$4 million through an Initial Public Offering (IPO). This enabled them to outsource production short term to a series of local manufacturers, including a motorcycle helmet manufacturer, before constructing their own manufacturing premises. Once in production, they began sourcing chips from both TI and Intel, running up large debts from both.

The Datapoint 3300 sold very successfully for a number of years. It was later rebadged as the DEC VT06 and the HP 2600A.

Having raised $4 million in an IPO in August 1969, selling over the counter for $8, by August 1970 the shares were selling at $45.

Ray and Roche wanted to develop a new more intelligent terminal, and employed a trio of engineers who knew each other from their interests in Amateur Radio: Victor Poor, Harry Pyle and undergraduate Jonathan Schmidt. While working his notice from Maryland-based Frederick Electronics during the 1969 Thanksgiving holiday, Poor and Pyle produced the underlying architecture of the modern microprocessor on a living room floor. They then asked Schmidt to write the accompanying communications software. Pitching the idea to both TI and Intel, the partnership developed the Intel 8008, the forerunner of the microprocessor chips found in today's personal and computing devices.

In December 1969 Poor joined CTC as Technical Director, employing Pyle within his team and sponsoring Schmidt through his degree. Ray and Roche asked how much of their design could fit onto a computer chip. Poor and Pyle developed a project that would cost $100,000 to place their architecture onto silicon and into production.

CTC did not believe it could meet its design goals for the CPU built from discrete TTL chips, and so Ray and Roche arranged dinner with Bob Noyce, the President of Intel, along with the President of Texas Instruments. Having pre-drawn the schematic for the microprocessor on two postcards, Ray gave one to each of his guests, and then made a bet: that the first company to build a computer on a chip (microprocessor) would forgive Datapoint their outstanding invoice. In part this was fiscally driven, as both supplier debts were large, and the annulment of either would mean that CTC could avoid a follow-on offering. Noyce initially questioned the approach, suggesting that development of the microprocessor would reduce Intel's sales of their dumb shift registers, but eventually agreed to the deal. The result was the development of the Intel 8008 microprocessor by Ted Hoff and Stan Mazor of Intel with IBM's Chief Scientist Larry Potter.

In later years, after the death of John Phil Ray, his widow and fellow dinner guest Brenda Ray Coffee was deposed by Baker Botts, the attorneys for Texas Instruments, when TI and Intel were involved in their lawsuit as to which one “invented” the microprocessor.

The company began development on the Datapoint 2200, its most popular product and credited by some historians as the invention of the personal computer. Poor and Pyle developed the instruction set architecture which enabled Phil Ray and Gus Roche to design and develop the mass-produced programmable Datapoint 2200 computer terminal, that could load various emulations stored on cassette tapes. Some users of the terminals chose to use them as simple programmable computers instead.

In the end, Intel could not meet Datapoint's product launch date, and consequently the 2200 was released using the conventional SSI/MSI chip technology of the time. Thus, today's overwhelmingly dominant instruction set architecture, used in Intel's x86 family of processors as well as all compatible CPUs from AMD and others, traces its ancestry directly back to CTC. The 2200 had an optional disk drive using Shugart , single-sided, single-density, and was the first commercial computer to include them. The Datapoint 2201 became so popular that CTC later changed its name to Datapoint Corp.

Despite the success of the 2200, the company lacked the finances and skills to manage its own production, and was hence quickly running out of cash. After Ray and Roche investigated and then dismissed selling the company, they agreed to a deal to gain an investment from TRW. However, after realising that his company would be competing with major customer IBM, the President of TRW pulled out of the deal, and renegotiated it as the purchase of overseas manufacturing rights. Combined with other institutional share sales, this raised the required $7M to finance the development of a new product.

However, on investigative audit the new investors found that Datapoint's corporate accounts hid various holes and challenges. After forcing the resignation of the company's first chairman, San Antonio insurance salesman Gerald Mazur, they appointed Harold O'Kelley, who had an engineering background and had been a vice-president of the electronics firm Harris Corporation, and formally renamed the firm Datapoint.

O'Kelley immediately realised that the TRW deal was fatally flawed. Effectively, it allowed TRW to manufacture outside North America, but then import the product and sell directly against Datapoint in North America. After renegotiations, O'Kelley and TRW agreed a new contract which allowed TRW to market the product outside North America, but not to manufacture it. He then raised an additional $8 million via a third Wall Street-backed public offering, with a plan to raise sales from $18M to $100M within five years. As a result, under the chairmanship of O'Kelley, between 1973 and 1981, revenues grew at a 40% pace, with sales surpassing $100M in 1977, reaching $450M by 1981.

This growth was only enabled through the development of various products through the partnership between Ray, Roche, Poor and Pyle. These included Datashare, a concept that allowed many terminals to communicate with each other independent of a mainframe. In 1976, Datapoint introduced a machine that automatically routed outgoing telephone calls onto the cheapest available line, there by liberalising the US Telecoms market after the AT&T breakup. It then introduced telephone directory software and word processing programs, as well as electronic mail functions.

Other Datapoint inventions were ARCnet, invented in 1977, originally called ARC (Attached Resource Computer), which was an early token-passing local area network (LAN) protocol, and the PL/B high-level programming language, which was originally called Databus (from Datapoint business language) and ran under the Datashare multi-user interpreter. Later developments included a Mapped Intelligent Disc System (MIDS) which networked 2200 series terminals to a single mass storage disc operating system and enhanced Distributed Data Processing. Proprietary operating systems included DOS and RMS, and Datapoint later moved its hardware to be based on Intel 386 CPUs.

ARCnet was briefly superseded by ARCnetplus, which provided throughput of 20 Mbit/s and include options such as LiteLink which used infra-red technology to link systems in adjacent buildings. This was launched around the time 100 Mbit/s Ethernet arrived so never really took much market share, even though ARCnet used simple, slender co-axial cable, not Ethernet's thick yellow cable, and despite have a slower transmission-speed had superior throughput, and was much simpler to configure and operate (servers could be connected and disconnected without taking the network down or reconfiguring).

Datapoint also developed and patented one of the earliest picture-in-picture implementations of videoconferencing called MINX (Multimedia Information Network eXchange). It was also part of the first video visitation and arraignment systems. It has been suggested they made more money from lawsuits over patent infringements than through sales of the product.

By the early 1980s, Datapoint ranked as a Fortune 500 company. Lead times were extending rapidly as demand for Datapoint products increased, leading to delivery delays and unhappy customers. Pressure to increase sales led to some questionable orders being accepted. Compounding this, many of the orders were simply placed to guarantee availability of the product at a future point when it was expected that actual orders would be in place. When these actual orders never materialized, the excess capacity and inventories initiated a financial collapse. Additionally, some of the actual customers went broke before paying their bills due to the general business slowdown. Such factors forced Datapoint to reverse sales or to record substantial bad debts, which caused the company to lose $800 million of its market capitalization in a matter of a few months in early 1982. The U.S. Securities and Exchange Commission (SEC) ordered Datapoint to stop this practice.

After cancelling the ground breaking ceremony in a new headquarters building in March 1982, the factory in Waco, Texas, closed in early 1982, and all Waco production transferred to the newer Fort Worth factory. The Ft. Worth Factory closed in 1985 as the company continued in a virtual free-fall, leaving the San Antonio factory (aka "9725") as the sole remaining factory in the US. Production shrank further and several San Antonio facilities were consolidated, with much factory space in 9725 being converted to offices to allow termination of office leases in the area. While numerous factory personnel moved from Waco to Ft. Worth, very few relocated from Ft. Worth to San Antonio, as the company was shrinking in size rapidly.

In December 1984, corporate raider Asher B. Edelman revealed that he had built up an 8% holding in Datapoint. In the same month Edelman offered $23 a share, or $416.3 million, to acquire the company. Datapoint's board rejected the offer but began inviting takeover proposals from other interested parties. Edelman then withdrew his bid, and began directly seeking shareholders' consent to oust Datapoint's board, replace them with his own designees and then sell the company to a third party or parties; his business takeover pattern deployed in other companies. Datapoint's board resultantly changed the company's bylaws to make the consent solicitation more difficult, a change Edelman later successfully blocked in court. In February 1985, Datapoint reported its predicted increased loss for the last quarter 1984, of $15.9 Million. After a three-month fight, on March 16 the board of Datapoint agreed to restructure the company, led by the immediate resignation of O'Kelley and his replacement as chairman by Edelman, who dropped his legal challenges.

After the Edelman takeover, Datapoint spun off its service division into Intelogic Trace, Inc., which initially specialized in servicing Datapoint equipment but later broadened into supporting products from other vendors as well. Intelogic Trace declared Chapter 11 bankruptcy, and on April 6, 1995, its assets were sold to a company in Pennsylvania.

Datapoint itself weathered a subsequent battle for control of the company that triggered more attention from the SEC. In December 1999, all of Datapoint's patented video communications technologies, along with all inventory and assets associated with the video business group was sold to one of its resellers, VUGATE. A handful of the loyal video group employees went to work for this company which is still selling the product today.

On May 3, 2000, Datapoint filed for Chapter 11 bankruptcy, and was broken up:

- Datapoint Corporation - on June 19, the company sold the Datapoint name and various operations to its European subsidiary for $49.3 million. The company changed its emphasis to call center equipment and largely pulled out of the computer market. Purchased by Alchemy Partners, in 2007 it acquired the assets of Touchbases' Avaya business to expand its footprint and extend into enterprise communications. Headquartered in Brentford, England, it has clients on 5,000 sites in 41 countries.

- Dynacore Holdings Corporation - on June 19, 2000, the remnant of Datapoint's US operations changed its name to Dynacore Holdings Corporation and formed a subsidiary that pursued 14 lawsuits based on two patents granted to Datapoint regarding local area networks. With only $1.3 million left from the sale of its European operations after paying its debts and no products left to sell — its total revenues for the first half of 2001 dwindled to $9,000 and a year later fell to nothing — Dynacore searched for a company to buy. In February 2003, Dynacore engaged in a reverse takeover of The CattleSale Company. Asher Edelman now sits in CattleSale's board of directors.

- Datapoint U.S.A., Inc. - in April 2003, Datapoint U.S.A., Inc. assumed control of all RMS Operating System based products from Datapoint Group(UK). Datapoint U.S.A., Inc. is based in San Antonio, TX and continues to provide RMS development, maintenance and support services to users worldwide. An office building and street in San Antonio still bear Datapoint's name, but is not associated with the residual US company.

A bond is a document of title for a loan. Bonds are issued, not only by businesses, but also by national, state or city governments, or other public bodies, or sometimes by individuals. Bonds are a loan to the company or other body. They are normally repayable within a stated period of time. Bonds earn interest at a fixed rate, which must usually be paid by the undertaking regardless of its financial results. A bondholder is a creditor of the undertaking.

Ebay ID: labarre_galleries