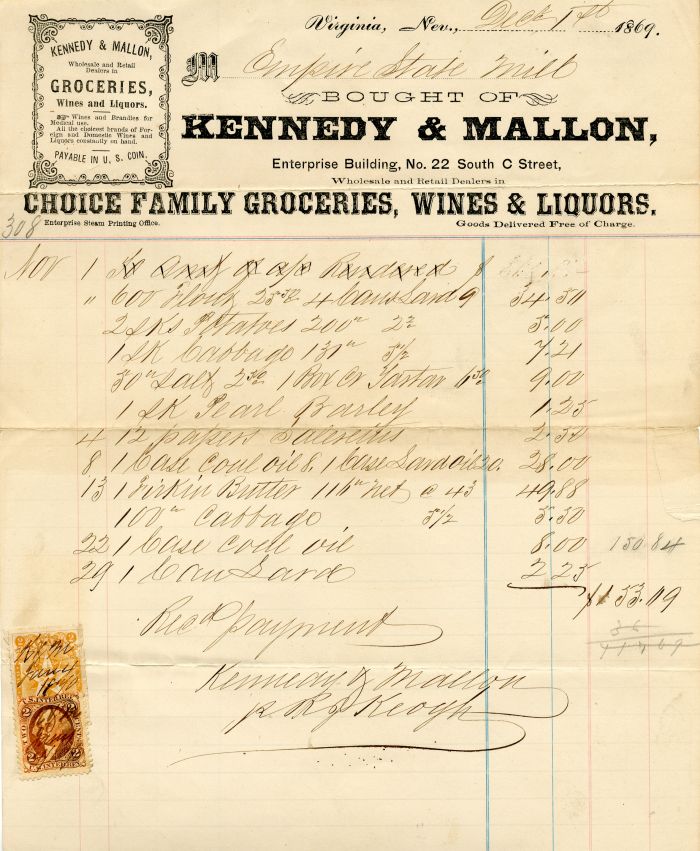

Groceries Invoice with Revenue Stamps - Americana

Inv# AM1855

Invoice for groceries from Kennedy & Mallon with two 2 cents revenue stamps.

The first revenue stamps in the United States were used briefly during colonial times, among the most notable usage involved the Stamp Act. Long after independence, the first revenue stamps printed by the United States government were issued in the midst of the American Civil War, prompted by the urgent need to raise revenue to pay for the great costs it incurred. After the war ended however, revenue stamps and the taxes they represented still continued. Revenue stamps served to pay tax duties on items that came under two main categories, Proprietary and Documentary. Proprietary stamps paid tax duties on goods like alcohol and tobacco, and were also used for various services, while Documentary stamps paid duties on legal documents, mortgage deeds, stocks and a fair number of other legal dealings. Proprietary and Documentary stamps often bore these respective designations, while in several of the issues they shared the same designs, sometimes with minor variations. Beginning in 1862 the first revenue stamps were issued, and would continue to be used for another hundred years and more. For the first twelve years George Washington was the only subject featured on U.S. revenue stamps, when in 1875 an allegorical figure of Liberty finally appeared. Revenue stamps were printed in many varieties and denominations and are widely sought after by collectors and historians. Revenue stamps were finally discontinued on December 31, 1967.

The first revenue stamps appeared in the years leading up to the American Revolution as a result of the 1765 Stamp Act, the taxes of which were not well received by the colonists of the day. These were the British colonial issues and required that many printed materials in the colonies be produced on specially prepared stamped paper produced in London which carried an embossed revenue stamp.

In August 1862, while the American Civil War was being waged, the United States (Union) government began taxing a variety of goods, services and legal dealings. To confirm that taxes were paid a 'revenue stamp' was purchased and appropriately affixed to the taxable item, which would in turn pay the tax duty involved.

The Commissioner of Internal Revenue took bids for the printing and production of the first U.S. revenue stamps in an effort to raise revenue for the great costs of the war. The Department of Internal Revenue awarded Butler & Carpenter of Philadelphia the printing contract who were paid $19,080 to produce one hundred and six printing plates, including the rolls, dies and all material necessary to maintain stamp production. Butler & Carpenter soon began producing the first revenue stamps which were issued for use beginning Oct. 1, 1862.

For reasons unknown the bill from Butler & Carpenter was never settled by the U.S. government until some years later, but not after Butler and Carpenter wrote and appealed numerous times to the commissioner of Internal Revenue, Hon. J.J. Lewis, about the matter. Because of the long wait involved one of the major points of contention was the appreciable amount of increase for materials between the time the agreement was made and when the bill was finally settled.

The new stamps were printed in several colors and depicted a portrait of George Washington on all thirty denominations from one-cent to $200. The engraved image of Washington was modeled after a painting by Gilbert Stuart. The first issues were printed on hard brittle paper and later printed on soft woven paper of varying thicknesses. Colors were generally dull for stamps printed before 1868. The stamps were issued in sheets perforated with 12 gauge perforations or 'imperforate', i.e.solid sheets with no perforations. Washington remained the only figure on the dozens of varieties issued up until 1874.

The new revenue stamps were used to pay tax on proprietary items such as playing cards, patent medicines and luxuries, and for various legal documents, stocks, transactions and various legal services. The cancellation of these stamps were usually done in pen and ink, while hand stamped cancellations were seldomly used and subsequently are more rare. When the Civil War ended it did not mean an end to revenue taxes as the federal government still had not paid the $2.7 billion debt it had acquired until 1883, at which time it finally repealed the excise tax. Three distinct revenue stamp series were produced to pay the taxes during that twenty one-year period.

Among the more notable instances of tax stamp usage occurred in the photography trade. As the Civil War progressed, the demand for photographs of family members, soldiers going off to war and returning war heroes increased dramatically, but not without the notice from the Federal government who saw the advent as an opportunity to raise much needed revenue for the war. On August 1, 1864 the Internal Revenue department passed a 'photograph tax' requiring photographers to pay a tax on the sale of their photographs. By 1864 there were no 'photography tax' stamps issued, so other stamps were substituted, typically, the proprietary or playing card revenue stamps was used, usually affixed to the back of the photograph. Already burdened with high overhead costs and scarcity of materials because of the war, large photograph companies organized and petitioned Congress, complaining that they were shouldering too much of the tax burden placed on the public. After exactly two years their constant efforts resulted in the tax being repealed on August 1, 1866. Several other widely used products, such as cotton, tobacco and alcohol, were also charged a proprietary tax which appreciably contributed to the revenues generated.

Ebay ID: labarre_galleries