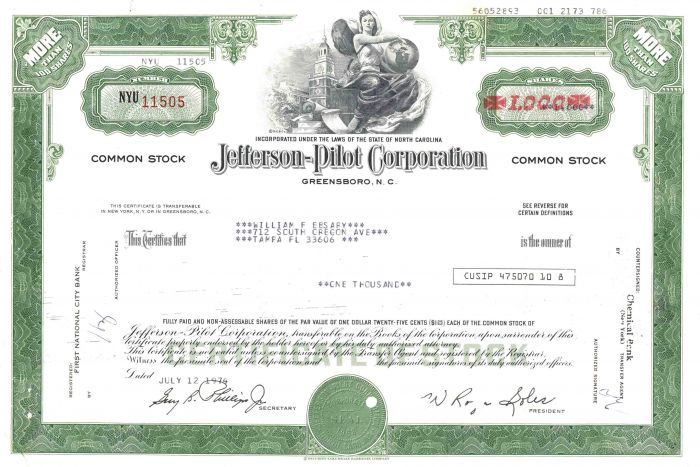

Jefferson-Pilot Corporation - Stock Certificate

Inv# GS6061 Stock

Stock printed by Security-Columbian Banknote Company. The Jefferson-Pilot Corporation is one of the largest shareholder-owned life insurance companies in the United States. During the first decade of the twentieth century, ten insurance companies were incorporated in Greensboro, the strongest of which was Security Life Insurance Company. At the same time, Jefferson Standard Life Insurance Company was founded in Raleigh, although by 1912 the company had depleted its surplus by paying excessive commissions to its agents. Security Life acquired the Raleigh firm and the new company created by the merger retained the name Jefferson Standard. Under the leadership of Julian W. Price, the company doubled its capital stock to $1 million by 1926. It survived the Great Depression by issuing policies designed to "meet the times" with a graduated payment scale that enabled people to hold on to their policies. Dividends continued to be paid, and the company continued buying bonds and lending money. It came to be considered one of Greensboro's depression-proof industries.

By 1950 Jefferson Standard's capital stock was valued at $15 million, and its total assets were $265 million. The company became Jefferson-Pilot Corporation in 1968 when a holding company was formed out of Jefferson Standard Life Insurance Company, Pilot Life Insurance Co., and Jefferson Standard Broadcasting Co. By 1980 Jefferson-Pilot's assets topped $1 billion. Despite one record year after another during the next decade, the presidency of W. Roger Soles, which had begun in 1967, was embroiled in controversy as several stockholders led by Julian Price descendant Louise Price Parsons crusaded to oust Soles for "mismanagement." An acrimonious dispute lasted from May 1991 until April 1993 and included a series of bitter courtroom episodes and turbulent stockholders meetings. The dispute was settled with the retirement of Soles, the implementation of a mandatory retirement age of 65 for officers, and a 20 percent reduction in the size of the board.

David Stonecipher of Atlanta took office as president of Jefferson-Pilot in April 1993. Stonecipher called for the company to double its life insurance sales and return to its roots of selling insurance. In a series of mergers, Jefferson-Pilot acquired Kentucky Central Life Insurance Company, Alexander Hamilton Life Insurance Company, Chubb Life Insurance Company, and Guarantee Life Insurance Company. By 1995 it was the second-fastest-growing insurance company and the fifteenth-largest life insurer in the United States. In January 1998 the company adopted Jefferson-Pilot Financial as its brand name to reflect its position as a "national company with financial savvy." By 2002 Jefferson-Pilot had 3,770 employees, and its companies had more than $210 billion of life insurance in force. One of its best-known subsidiaries, Jefferson-Pilot Communications Company, in 2004 owned 3 television stations and 18 radio stations in the Southeast. Jefferson-Pilot Corporation underwent a merger with Lincoln National Corporation in April 2006, with the new company operating under the name Lincoln Financial Group. (by Alexander R. Stoesen, 2006)

A stock certificate is issued by businesses, usually companies. A stock is part of the permanent finance of a business. Normally, they are never repaid, and the investor can recover his/her money only by selling to another investor. Most stocks, or also called shares, earn dividends, at the business's discretion, depending on how well it has traded. A stockholder or shareholder is a part-owner of the business that issued the stock certificates.

Ebay ID: labarre_galleries