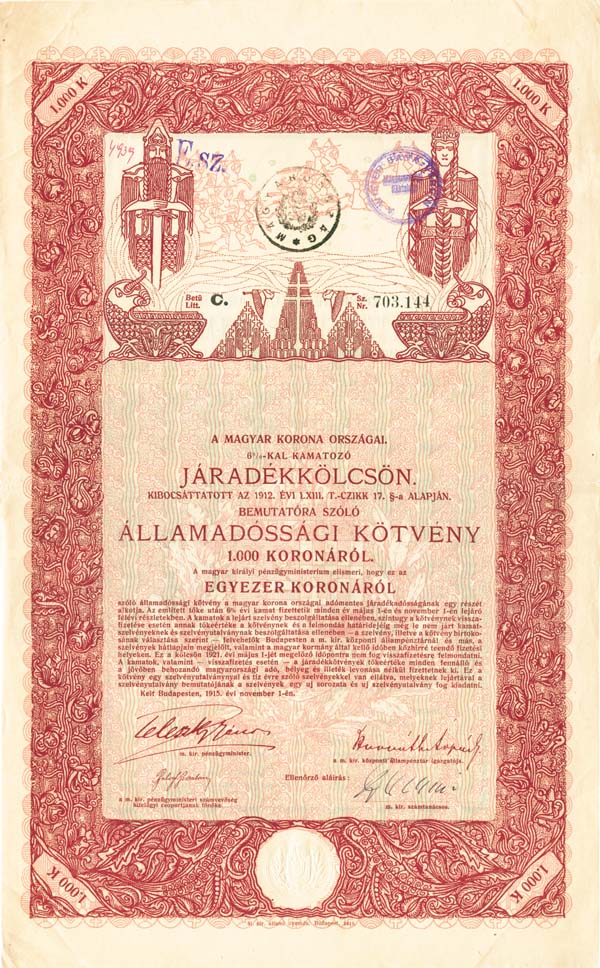

Kingdom of Hungary - State Bond (Uncanceled) - Various Denominations

Inv# FB5115 Bond

The Krone or korona (German: Krone, Hungarian: korona, Italian: Corona, Polish: korona, Slovene: krona, Serbo-Croatian: kruna, Czech: koruna, Slovak: koruna, Romanian: coroană) was the official currency of Austria-Hungary from 1892 (when it replaced the Austro-Hungarian gulden as part of the adoption of the gold standard) until the dissolution of the empire in 1918. The subunit was one hundredth of the main unit, and was called a Heller in the Austrian and a fillér in the Hungarian part of the Empire. The official name of the currency was Krone (lit. 'crown', pl. Kronen) in Austria and korona in Hungary. The Latin form Corona (plural Coronæ), abbreviated to Cor. on the smaller coins, was used for the coinage of the mostly German-speaking part of the empire known as Cisleithania. Currency names in other ethnic languages were also recognised and appeared on the banknotes: koruna (pl. korun) in Czech, korona (pl. korony) in Polish, корона, korona (pl. корон, koron) in Ukrainian, corona (pl. corone) in Italian, krona (pl. kron) in Slovene, kruna (pl. kruna) in Croatian, круна, kruna (singular and plural) in Serbian, koruna (pl. korún) in Slovak, and coroană (pl. coroane) in Romanian. These terms all translate to the English word crown. The symbol of the currency was the abbreviation K. or sometimes Kr. After several earlier attempts the Austro-Hungarian Empire adopted the gold standard in 1892 according to a plan drawn up by the Hungarian Minister of Finance Sándor Wekerle. This plan included the introduction of the new currency, the Krone. It consisted of 100 Heller (Austria) or Fillér (Hungary). The value of the Krone was set at 2 Kronen = 1 Gulden (Florin, or forint in Hungarian) of the previous silver-based currency. From 1900 onward, Krone notes were the only legal banknotes of the Empire. The currency depreciated sharply as a result of the First World War, which was financed mostly by the issue of War Bonds rather than through taxation. Consumer prices rose sixteenfold during the war, as the government had no hesitation in running the Austro-Hungarian Bank's printing presses to pay its bills: this triggered a higher inflation rate than in other combatant countries. After the end of the First World War it was initially hoped that the Krone might remain the common currency of the Empire's successor states, but in January 1919 the Kingdom of Serbs, Croats, and Slovenes (later Yugoslavia) became the first successor state to overstamp the Austro-Hungarian Bank's notes, limiting their validity to its own territory. Czechoslovakia followed suit in February 1919, and on 12 March 1919 the new Republic of Austria stamped the notes circulating in its territory with "DEUTSCHÖSTERREICH". The Austrian economy did not stabilise after the war, and a period of hyperinflation followed: the money supply increased from 12 to 30 billion Kronen in 1920, and to about 147 billion Kronen at the end of 1921. In August 1922 consumer prices were 14,000 times greater than before the start of the war eight years earlier. The highest-denomination banknote issued was the 500,000 Kronen note, issued in 1922. Faith in the currency had been lost, and people spent money as fast as they received it. In October 1922 Austria secured a loan of 650 million gold Kronen from the League of Nations, with a League of Nations Commissioner supervising the country's finances. This stabilized the currency at a rate of 14,400 paper Kronen to 1 gold Krone. On 2 January 1923 the Austrian National Bank (Österreichische Nationalbank) began operations, taking over control of the currency from the Austro-Hungarian Bank which had gone into liquidation. In December 1923 the Austrian Parliament authorised the government to issue silver 5,000, 10,000, and 20,000-kronen coins which were to be designated half-Schilling, Schilling, and double Schilling. The Schilling became the official currency of Austria currency on 20 December 1924, at a rate of 10,000 Kronen to 1 Schilling.

A bond is a document of title for a loan. Bonds are issued, not only by businesses, but also by national, state or city governments, or other public bodies, or sometimes by individuals. Bonds are a loan to the company or other body. They are normally repayable within a stated period of time. Bonds earn interest at a fixed rate, which must usually be paid by the undertaking regardless of its financial results. A bondholder is a creditor of the undertaking.

Ebay ID: labarre_galleries