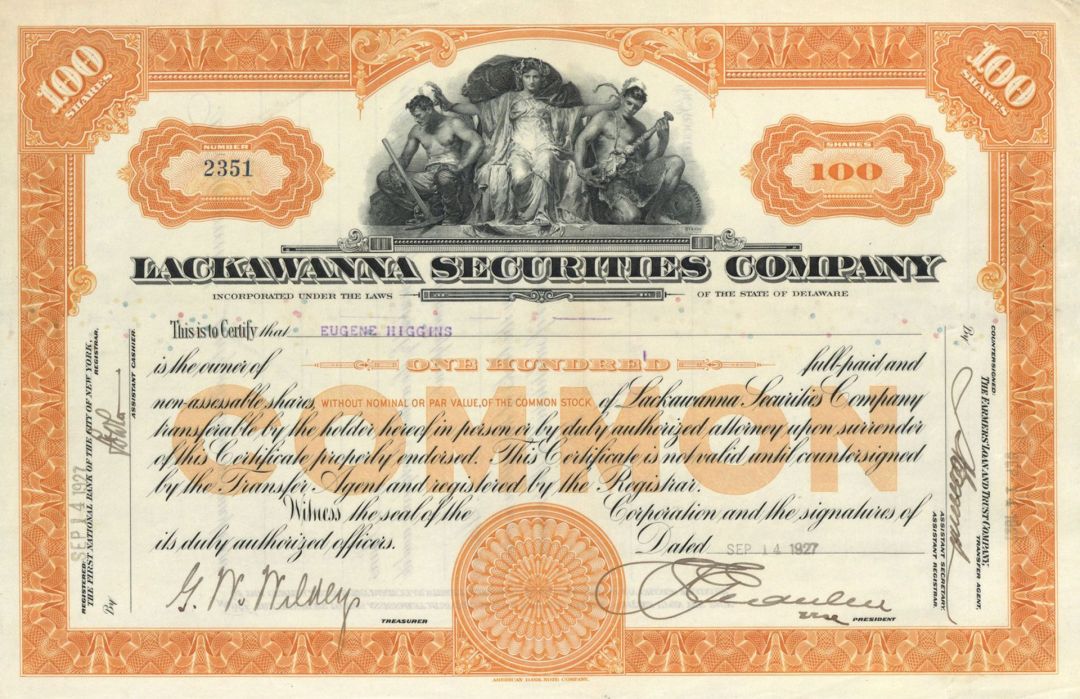

Lackawanna Securities Co. - Securities Stock Certificate

Inv# GS1160 StockGeneral Stock printed by American Bank Note Company. Superb vignette of female figure with a male at each side! Rare!!! Please specify Color.

Fairly typical of the general situation is the history of the Delaware, Lackawanna and Western. Prior to 1909 the railway owned coal lands, mined coal, and sold it, in addition to performing its functions as a carrier. About the time the socalled "commodities clause,” which prohibits a railway from transporting commodities produced or owned by it, was added to the Interstate Commerce Commission law, the railway organized the Delaware, Lackawanna and Western Coal Company which acted as a selling concern. Further action by the government led it in September, 1921, to dispose of its coal properties, turning them over to the Glen Alden Coal Company. The Glen Alden shares were offered to the railway's stockholders, and Glen Alden bonds were issued to the railway company. In March, 1927, Glen Alden bonds were turned over to the Lackawanna Securities Company, formed in that year as the last step in the complete segregation of the coal properties. A proposal was then made to distribute Lackawanna Securities Company stock to the Delaware, Lackawanna and Western stockholders and this feature of the plan has met the approval of the Interstate Commerce Commission. (From The Business of Railway Transportation, Traffic-Rates-Regulations by Lewis Henry Haney)

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants.

Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic (dematerialized) or "book entry only" form. Certificates may be bearer, meaning they entitle the holder to rights under the security merely by holding the security, or registered, meaning they entitle the holder to rights only if they appear on a security register maintained by the issuer or an intermediary. They include shares of corporate stock or mutual funds, bonds issued by corporations or governmental agencies, stock options or other options, limited partnership units, and various other formal investment instruments that are negotiable and fungible. Read more at https://en.wikipedia.org/wiki/Security_(finance)

A stock certificate is issued by businesses, usually companies. A stock is part of the permanent finance of a business. Normally, they are never repaid, and the investor can recover his/her money only by selling to another investor. Most stocks, or also called shares, earn dividends, at the business's discretion, depending on how well it has traded. A stockholder or shareholder is a part-owner of the business that issued the stock certificates.

Ebay ID: labarre_galleries