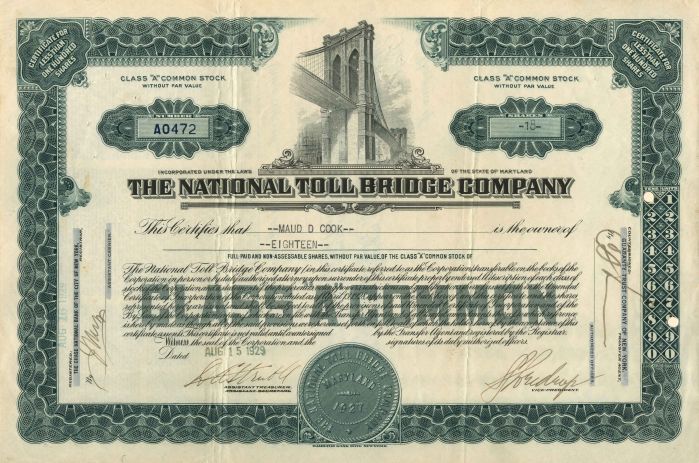

National Toll Bridge Co. - 1929 dated Stock Certificate

Inv# GS5937 Stock

Stock printed by Hamilton Bank Note, New York. Available in Blue or Brown. Please specify color. A toll bridge is a bridge where a monetary charge (or toll) is required to pass over. Generally the private or public owner, builder and maintainer of the bridge uses the toll to recoup their investment, in much the same way as a toll road. The practice of collecting tolls on bridges harks back to the days of ferry crossings where people paid a fee to be ferried across stretches of water. As boats became impractical to carry large loads, ferry operators looked for new sources of revenue. Having built a bridge, they hoped to recoup their investment by charging tolls for people, animals, vehicles, and goods to cross it.

The original London Bridge across the river Thames opened as a toll bridge, but an accumulation of funds by the charitable trust that operated the bridge (Bridge House Estates) saw that the charges were dropped. Using interest on its capital assets, the trust now owns and runs all seven central London bridges at no cost to taxpayers or users. In the United States, private ownership of toll bridges peaked in the mid-19th century, and by the turn of the 20th century most toll bridges were taken over by state highway departments. In some instances, a quasi-governmental authority was formed, and toll revenue bonds were issued to raise funds for construction or operation (or both) of the facility. Read more at https://en.wikipedia.org/wiki/Toll_bridge

A stock certificate is issued by businesses, usually companies. A stock is part of the permanent finance of a business. Normally, they are never repaid, and the investor can recover his/her money only by selling to another investor. Most stocks, or also called shares, earn dividends, at the business's discretion, depending on how well it has traded. A stockholder or shareholder is a part-owner of the business that issued the stock certificates.

Ebay ID: labarre_galleries