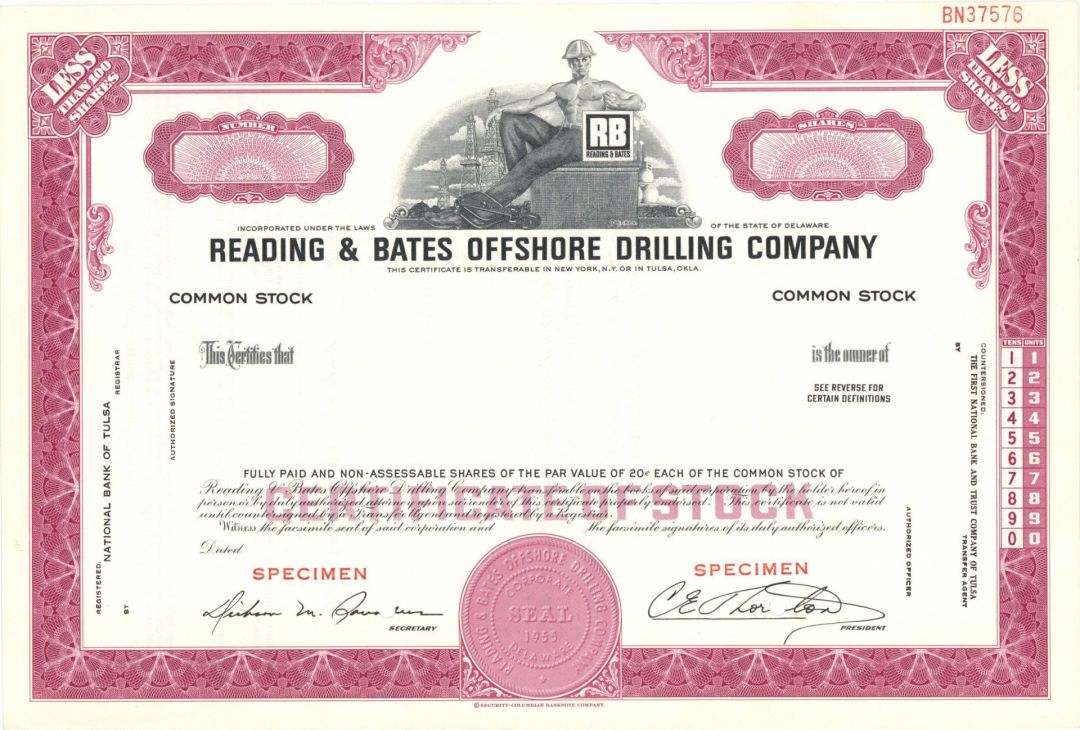

Reading and Bates Offshore Drilling Co. - Specimen Stock Certificate

Inv# SE3678 Specimen StockNew York

Oklahoma

Specimen Stock printed by Security-Columbian Banknote Company. Please specify color.

TODCO (The Offshore Drilling Co.) is a New York Stock Exchange-listed company based in Houston that provides contract oil and gas drilling services, mostly to major international oil companies, state-owned oil companies, and independent oil and gas companies. TODCOâs fleet is composed of 64 drilling rigs, including 24 shallow water jackups, 27 inland barge rigs, nine land rigs, three submersible drilling units, and one platform rig. They operate in the shallow waters and inland areas of the Gulf of Mexico as well as the Caribbean Basin off the shores of Mexico, Venezuela, and Trinidad. TODCO also holds a 25 percent interest in Delta Towing, which operates a fleet of more than 40 support vessels, including inland tugs, offshore tugs, crewboats, deck barges, shale barges, spud barges, and a single offshore barge. In addition to the Houston home office, TODCO maintains operational offices in Houma, Louisiana; Maturin, Venezuela; La Romaine, Trinidad; Luanda, Angola; Rio de Janeiro, Brazil; and Ciudad del Carmen, Mexico. Warehouse and yard facilities are located in Houma, La Romaine, and Maturin.

TODCOâs roots date back to the Great Depression of the 1930s when two true pioneers of the oil and gas industry, J. W. âJackâ Bates, Sr., and George M. Reading, became partners. Bates came west to California after receiving a degree from Dartmouth College, starting out in the oil industry at the lowest ranks, working as a mule skinner. Reading was a University of California-educated mining engineer. The two men met in Texas in 1930 when Bates was general superintendent for Rox-anna Petroleum, which later took the name Shell Oil Company, and Reading was one of his drilling contractors. In 1935 they became partners, forming Tulsa, Oklahoma-based Reading & Bates Drilling Co. with three drilling rigs they acquired on credit. The company enjoyed steady growth drilling contract wells in Oklahoma, Texas, and Kansas. In 1949 Jack Bates, Jr., took over the presidency, then two years later took on a partner of his own, Charlie Thornton, a former Gulf Oil petroleum engineer who headed a Canadian subsidiary. In 1955 they incorporated Reading & Bates Offshore Drilling Co., a subsidiary that would one day become part of TODCO. Its rigs operated in the Gulf of Mexico as well as the Persian Gulf in the Middle East. The company became one of the first drilling contractors to work in the North Sea, and in the late 1960s began growing its fleet and adding capabilities, such as pollution control technology and ocean engineering. Reading & Bates continued to operate land rigs in Iran, but in the late 1970s the Shah was overthrown in a revolution and the equipment was confiscated. Having lost most of its land rigs, Reading & Bates simply exited this part of the business. The company was involved in exploration and other areas, but following the collapse of the oil and gas industry after the price of oil fell to the $8â$10 per barrel range in 1986, Reading & Bates undertook a restructuring. In 1989 it moved its headquarters to Houston and by 1991 divested most of its assets in order to concentrate on offshore drilling contracting, especially deepwater and difficult environments. A new unit was also formed in 1990, Reading & Bates Development Co., to provide floating production platform services and other specialized drilling services as well as to invest in wells the company drilled. The decision to focus on deepwater drilling was made in part because oil prices were rising in the early 1990s, making it economically viable for oil companies to drill in deepwater, which was a more costly endeavor. Moreover, many of the most promising energy plays left to exploit were located in the deepest parts of the ocean. At the time, offshore contract drilling was a highly fragmented field, so much so that the top three companies controlled little more than a quarter of the market. Oil producers, as a result, were in an enviable position, able to take advantage of any dip in oil or gas prices to demand a reduction in the day rate of drilling rigs. If the contractors tried to grow their business by building more rigs, they only added to the total number of rigs available, worsening the supply/demand imbalance. Hence, the wisest course of action was to acquire competitorsâ rigs, and in the mid-1990s there was a great deal of consolidation in the field. Sonat Offshore tried to acquire Reading & Bates but was rebuffed. Reading & Bates tried to acquire Norwayâs Transocean ASA but lost out to Sonat. The two companies merged to become Transocean Offshore. In 1997 Reading & Bates found a willing partner in Falcon Drilling Company, whose chief executive, Steven A. Webster, was a longtime friend of Reading & Batesâs CEO, Paul Loyd. They became acquainted at Harvard Business School, where they both graduated in 1975. They then worked together as consultants in Saudi Arabia and became partners in some small ventures. In 1988 Webster founded Falcon as an offshore drilling contractor. He grew the business rapidly, focusing on shallow water, and took it public in 1995. By the time it merged with Reading & Bates, Falcon operated the largest fleet of barge rigs in the world, and was worth $1.6 billion. Read more at https://www.encyclopedia.com/books/politics-and-business-magazines/todco

Stock and Bond Specimens are made and usually retained by a printer as a record of the contract with a client, generally with manuscript contract notes such as the quantity printed. Specimens are sometimes produced for use by the printing company's sales team as examples of the firms products. These are usually marked "Specimen" and have no serial numbers.

Ebay ID: labarre_galleries