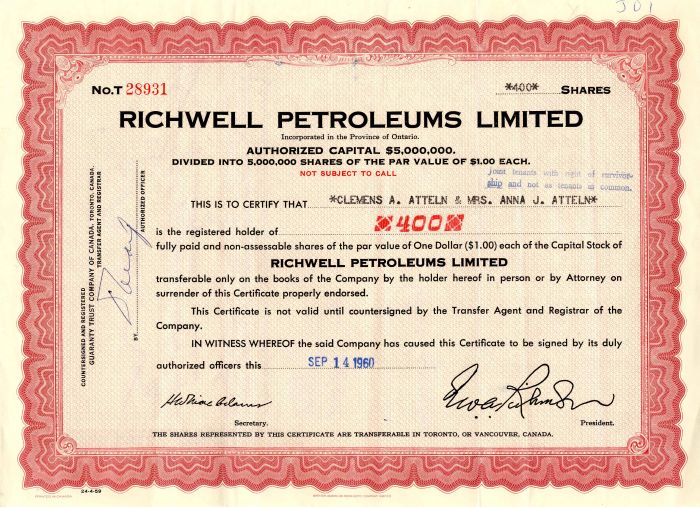

Richwell Petroleums Limited - Canadian Oil Stock Certificate

Inv# OS1680 Stock

Stock printed by British American Bank Note Company, Limited. Ontario, Canada.

Although there are numerous oil companies operating in Canada, as of 2009, the majority of production, refining and marketing was done by fewer than 20 of them. According to the 2013 edition of Forbes Global 2000, canoils.com and any other list that emphasizes market capitalization and revenue when sizing up companies, as of March 31, 2014 these are the largest Canada-based oil and gas companies (they are either based entirely in Canada or majority Canadian owned).

As of 2009, Syncrude and Irving Oil were leaders in the Canadian industry, with Syncrude being the top producer of oil sands crude and Irving Oil operating the largest oil refinery in the country.

Canadian oil company profits quickly recovered following the 2008 financial crisis; In 2009 they were down 90% but in 2010 they reached $8.4 billion. The price gap between West Texas Intermediate oil ($85/bbl) and Western Canadian Select heavy crude ($65/bbl) with the price of upgraded synthetic oil surpassing WTI when supply falls (before being upgraded to synthetic crude, heavier oil produces fewer barrels of oil per metric ton than lighter oil). As of 2011, there were 2,412 oil and gas companies based in Calgary, Alberta alone.

According to a University of Calgary petroleum geologist, most oil sands companies in 2011 were still using 1980s recovery process technologies. With the price of oil at $USD100, there was no incentive for companies to invest in research and innovation to be profitable. By 2001, the first commercial steam-assisted gravity drainage facility was started, and by 2011, there was more oil extracted from the oil sands using in situ steam-assisted gravity drainage (SAGD) than traditional bitumen strip mining extraction with its massive trucks, tailings ponds. By 2005, the petroleum industry in Canada began a major shift as oil producers renewed an interest in research and development projects to improve bitumen extraction technology and processing methods. From 2005 to 2010, ten oil and gas companies—including Suncor, Imperial Oil, Nexen, Calfrac and Laricina Energy Ltd.—increased the number of patent applications for new technologies to increase the amount of bitumen that can be recovered. According to the industry, in 2011, only 10% of the 1.6 trillion barrels (250 km3) of crude buried in the oil sands, could be recovered with the 1980s technologies.

Canadian oil and gas companies with a market cap were included in the 2009 Forbes 500 list. In 2011, The Globe and Mail included eight oil and gas companies in their ranking of Canada's 1000 most profitable public companies. By 2013, Suncor and CNRL—Canada's two largest petroleum companies were also among top eleven of the country's most valuable companies.

In 2011, Canadian Natural Resources, overtook Suncor to become Canada's largest producer. Suncor produced 549,000 boe/d in 2012 only slightly higher than in 2011. In 2010, Canadian Natural Resources produced at a gross rate of 655,000 boe/d up from 600,000 boe/d the year before.

A stock certificate is issued by businesses, usually companies. A stock is part of the permanent finance of a business. Normally, they are never repaid, and the investor can recover his/her money only by selling to another investor. Most stocks, or also called shares, earn dividends, at the business's discretion, depending on how well it has traded. A stockholder or shareholder is a part-owner of the business that issued the stock certificates.

Ebay ID: labarre_galleries