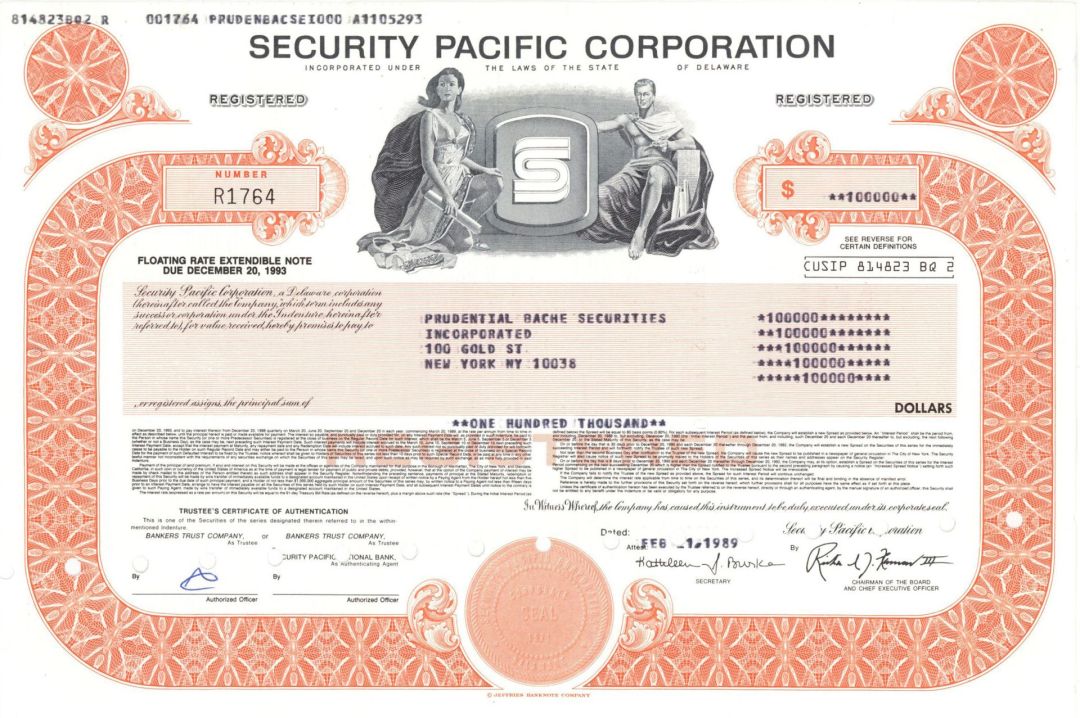

Security Pacific Corp. - 1989 dated $100,000 Bond

Inv# HD1017 Bond$100,000 Bond printed by Jeffries Banknote Co.

In the space of two decades, Security Pacific has grown from a mid-sized regional southern California bank into the nation’s sixth-largest bank-holding company and an international player in a range of non-banking financial industries. SecPac has shed the image that gave it the name “Security Pathetic” for its once meager earnings, and has steadily gone about the business of diversifying from traditional banking into the securities and capital markets, venture capital, currency trading, and insurance and commercial leasing in the United States, Europe, and Asia. Security Pacific began in 1871 as the Farmers and Merchants Bank. Both a consumer and a commercial bank from its start, the Merchants and Farmers, which became the Security First National Bank of Los Angeles in 1929, continued to grow, often by acquisition, to become a major southern Californian bank. By the late 1960s, it was ready to expand beyond California. At that time, the top management team consisted of Chairman and CEO Frederick Larkin Jr., President Carl Hartnack, and head of international and corporate banking Richard Flamson III, a tough, demanding, outspoken executive who once worked repossessing cars before beginning his banking career with SecPac. These three men believed that deregulation of the banking industry was inevitable and that traditional banking activities could no longer sustain the kind of growth they felt their company needed. They opened offices in New York, Tokyo, London, and Sydney, and they also bought a northern California bank called Pacific National Bank, resulting in a name change to Security Pacific Bank. When the Bank Holding Company Act was passed and banks were allowed to own non-banking financial subsidiaries, the company reincorporated in 1971 as Security Pacific Corporation. It then set about implementing a diversification strategy that went into high gear when Flamson took over as chairman and CEO in 1978. Today, the company is divided into three major divisions: Security Pacific Bank, which functions as a retail and commercial bank in California and as a merchant bank in California and in the capital markets around the world; the interstate banking network, which includes consumer and commercial banks in several other western states; and the financial services system, which began as a small consumer finance subsidiary and has expanded nationwide and diversified into international commercial finance, leasing, and venture capital projects in the United States and England. In practice, these divisions function as a loose confederation of independent businesses rather than as an interdependent, synergistic conglomerate. Although he is routinely described as a gambler and a risk-taker, Richard Flamson has insisted in published interviews that he “never bets the company.” While many analysts have questioned SecPac’s seemingly inscrutable trail of acquisitions, Flamson maintains that they are carefully chosen and that extensive groundwork precedes every acquisition. A good example is the company’s entry into the consumer finance market in 1974. The bank began by hiring William Ford, an executive from the General Electric Credit Corporation, to set up a consumer finance business. After that turned a profit in its first year, the company bought a small Kansas-based finance company, Bankers Investment. Once they were convinced that consumer finance was a good business to be in, SecPac purchased Maryland-based American Finance Systems, with 390 offices in 39 states. By 1987, the consumer finance division employed 3,500 people in 45 states and netted the company almost $60 million. SecPac used a similar strategy to gain a seat on the London stock exchange. In July of 1984, the company purchased John Govett & Company, an English investment management company, but it wasn’t until 1986 that the bank increased its ownership of the renamed Hoare Govett Ltd. to 83%, giving it greater flexibility in the operation. Other recent international acquisitions include a West German finance company and a Canadian commercial bank. The holding company currently has offices in 23 foreign countries and maintains 24-hour trading rooms in seven different countries. In 1988 it acquired 30% of Burns Fry Ltd., a Toronto broker. While SecPac has set its sights far afield, it has also kept a close eye on its own backyard, purchasing major banks in Arizona, Washington, Oregon, Alaska, Nevada, and northern California in the late 1980s. These acquisitions have given Security Pacific a very strong retail network, and access to approximately 30% of the nation’s mortgage market. In the ten years since Flamson took over as CEO, assets have grown from $22 billion to over $87 billion, and profits have increased by 15% to 17% a year for most of the decade. That growth came to an abrupt halt in 1987, when the company decided to take action to resolve its exposure to the growing Third World debt crisis. With more than $2 billion at risk, company officials felt they could no longer sit back and hope for a change, and in 1987, they diverted over $900 million toward a special reserve fund for unpaid loans to developing countries. The action followed several years of write-offs totaling hundreds of millions of dollars, and resulted in a net income of only $15.7 million for the year instead of an after-tax profit of $518 million, but the company now has more than half of its non-trade related outstanding loans to Third World countries covered and has eliminated its exposure in five developing countries. More than two-thirds of its extant outstanding loans are to Mexico and Brazil. This problem was compounded by the October, 1987 crash, which forced the company’s securities business to retrench. Flamson told Business Week in May, 1988 that acquisitions would slow down because of plummeting profits in the securities subsidiaries. But Flamson remains optimistic about his diversification strategy. He says that Security Pacific will continue to push for further deregulation so that it can compete more heavily in the insurance, securities, and real estate fields. He has also demonstrated his willingness to pay top salaries for talented executives from other companies, prefering to use managers from the appropriate industries to head SecPac’s non-banking subsidiaries. Through the company’s merchant banking arm, SecPac acted as the agent in a $1.65 billion refinancing of Allied Stores in 1987. The same subsidiary acted as agent or co-manager in $2 billion worth of additional projects in the entertainment and construction industries, and ended up with almost $100 million in income from the merchant bank alone. The growth of the company’s global merchant banking division has led to comparisons with financial giant Citibank, but while Citibank seems to want to be everything to everybody, SecPac officials insist that they are more interested in mining specialty niches. Security Pacific has also been a leader in the development of automated teller systems and other electronic advancements in the banking industry and maintains a fulltime subsidiary of 5,500 employees for this purpose. Flamson is credited with much of Security Pacific’s success of the past decade. He has a few years left before retirement, and though he has promised to slow down his acquisitions, he has also conceded that he is looking to gain a toehold in the Tokyo market. He is said to have a relaxed collegial style during his weekly meetings with the senior management team, and a loose overview of the whole organization. His philosophy and style were best represented by a statement he made to Institutional Investor describing the key to his success: “You don’t need a Ph.D., but you do need market sense, street sense and common sense to make a business plan so the pieces go together.”

A bond is a document of title for a loan. Bonds are issued, not only by businesses, but also by national, state or city governments, or other public bodies, or sometimes by individuals. Bonds are a loan to the company or other body. They are normally repayable within a stated period of time. Bonds earn interest at a fixed rate, which must usually be paid by the undertaking regardless of its financial results. A bondholder is a creditor of the undertaking.

Ebay ID: labarre_galleries