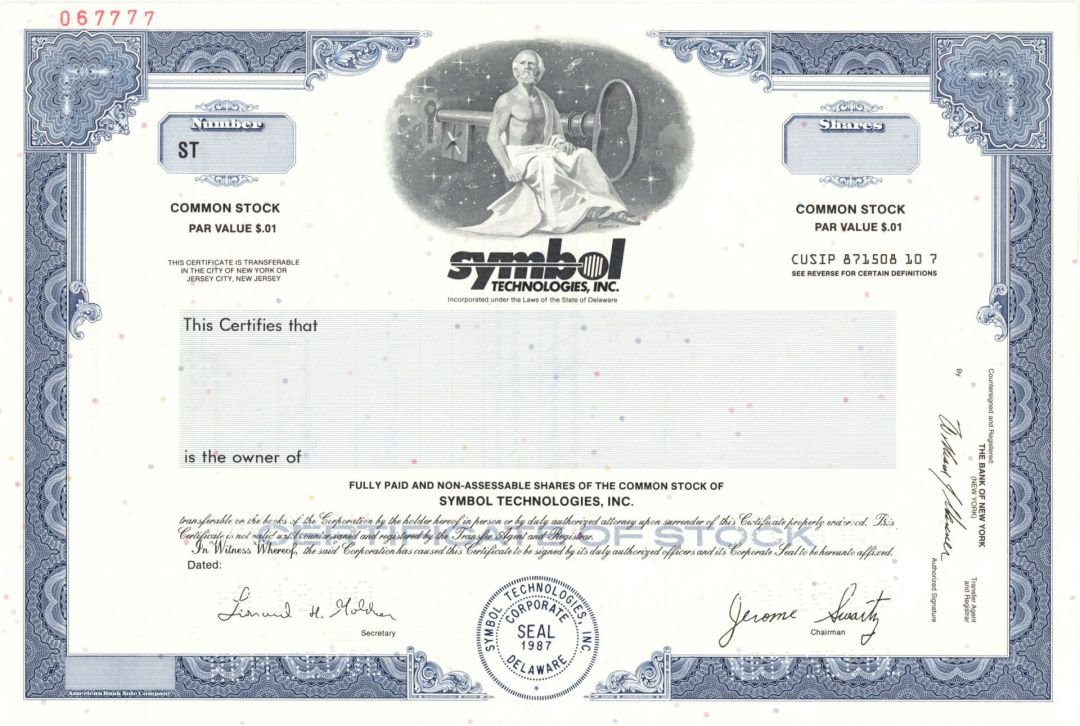

Symbol Technologies, Inc. - 2000 Specimen Stock Certificate

Inv# SE3918 Specimen StockNew Jersey

New York

Specimen Stock printed by American Bank Note Company. Incorporated in 1987.

Symbol Technologies is an American manufacturer and supplier of mobile data capture and delivery equipment. The company specializes in barcode scanners, mobile computers, RFID systems and Wireless LAN infrastructure. In 2014, Symbol Technologies became a subsidiary of Zebra Technologies, and is headquartered in Holtsville, New York, on Long Island.

The company was co-founded in 1973 by Jerome Swartz and physicist Shelley A. Harrison. At that time, the company focused on handheld laser-based scanning of bar codes. Under Swartz, the company marketed handheld laser bar code scanning devices. The company focused heavily on the retail industry and began to get involved in inventory management. These activities typically required people to scan items where they are stored and as such needed to be mobile. Symbol began to make small computers that could store data scanned to take inventory counts remotely and then upload the information gathered to a host system. This was the rationale for the September 1988 purchase of MSI Data Corporation, a mobile computer company that was headquartered in southern California, for $120 million. The mobile computers being manufactured at the time relied on static memory (in this case SRAM) for execution space and general storage. SRAM was extremely expensive and the team determined that it would be an improvement to use a radio to allow the mobile computer to be untethered but connected to the host system. A thin client architecture was adopted in conjunction with a spread spectrum radio network. The enterprise mobility management market was dominated by Symbol Technologies and Telxon, Inc. Most notably, these two companies serviced major retailers such as Wal-Mart, Kroger, Safeway, Federated and others. A notable turning point occurred in 1994 with a competition for business at Kroger. Symbol Technologies and Telxon were operating radio networks in the 2.4 GHz ISM bands. IEEE 802.11 was not yet ratified, so Symbol and Telxon were free to define competing standards of communication at this frequency band. Symbol settled on frequency hopping as the most robust, agile and interference-tolerant approach to data communications while Telxon selected direct sequence technology which they felt afforded higher transfer speeds with adequate interference immunity. Kroger ordered a head-to-head comparison test. Ultimately and not decisively, Kroger chose Telxon. At about the same time, the IEEE decided to adopt the direct sequence approach in its IEEE 802.11b standard. The ratification of IEEE 802.11b was a huge blow to the Symbol team which now had to reconfigure and engineer a direct sequence radio system. This was accomplished with great pains and IEEE 802.11b became a reality in the industrial and commercial markets far before the radios were available to the consumer market. The addition of a radio to a mobile device was roughly estimated to have a real value of between $500 and $1000 per unit. This was paid by enterprise customers that desperately needed this feature to accomplish their operations. Later on Symbol started to sell the radios as PC Cards as a stand-alone product to various original equipment manufacturers (OEMs) and private label customers. These included 3Com, Nokia and Intel. The Symbol team had temporarily dominated the IEEE 802.11b market. Telxon was facing difficulties and, in the meantime, Intel, Apple Inc. and Cisco were looking at the technology to see how they would use this to their commercial advantage. Cisco investigated the acquisition of various manufacturers of wireless gear to augment their commanding position in the wired infrastructure field. Cisco performed due diligence with both Symbol and Telxon, deciding to purchase the Aironet component of Telxon that designed and manufactured the radios. The Cisco purchase of Telxon's Aironet division marked the inflection point of the market moving from a specialized, esoteric market to a mass consumer and enterprise market. In June 1998, Telxon rejected a hostile takeover bid of $668 million made by Symbol. The ensuing proxy battle lasted two years, and in December 2000 Symbol was able to complete the takeover at a much lower price of $465 million. In 2004 Symbol acquired Matrics, helping the company to push further into the RFID field. Read more at https://en.wikipedia.org/wiki/Symbol_Technologies

Stock and Bond Specimens are made and usually retained by a printer as a record of the contract with a client, generally with manuscript contract notes such as the quantity printed. Specimens are sometimes produced for use by the printing company's sales team as examples of the firms products. These are usually marked "Specimen" and have no serial numbers.

Ebay ID: labarre_galleries