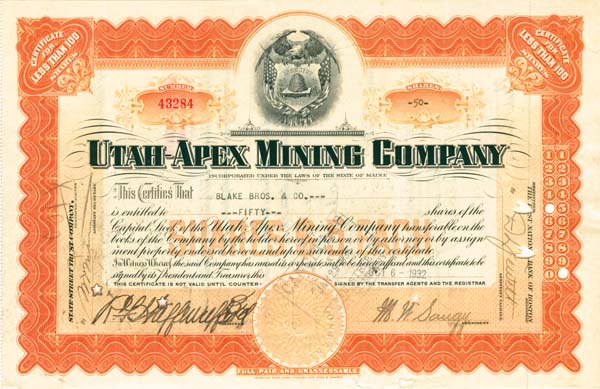

Utah-Apex Mining Co. - Stock Certificate

Inv# MS1062 Stock

Utah

UTAH-APEX MININO CO. UTAH- Office: 53 Tremont St., Boston, Mass. Operating office: 306 Anerbaoh Bldg., Salt Lake City, Utah. Mine office: Bingham Canyon, Salt Lake Co.. Utah. Employs 60 men. E. R. Hastings, president; John W. Home, treasurer; preceding officers, Henry R. Bradley, Jas. D. Casey, Wm. F. Fitzgerald, John P. Gorman, R. F. Haffenreffer, Jr., Cowley Lambert and Chas. A. Morse, directors; Robt. S. Oliver, general manager; H. L. Parker, superintendent; E. D. Gardner, engineer; Arthur L. Pearse, consulting engineer. Organized May, 1902, under laws of Maine, as a merger of Copperfield Mining Co. and York Mining Co., with capitalization $2,500,000, increased, 1906, to $3,000,000, shares $5 par. leaned 26,000 shares of new stock, to shareholders, early 1907, and stock outstanding, April, 1907, was $2,641,000. Has authorized the issue of $500,000 convertible bonds, at 6%; outstanding, $189,000, September, 1908. Owns a 50% interest in the Markham Gulch Mining & Milling Co., which has a 150-ton mill. Has absorbed, since organization, the Highland Boy Mining Co., Petro Mining Co. and Minnie Mining Co., and December, 1908, secured, for circa $100,000, a controlling share interest in the Phoenix Mining Co., property of which adjoins the Utah-Apex. Federal Trust Co., Boston, registrar. Annual meeting, second Tuesday in September. Lands, 24 claims, area 162 acres, on York Hill, in Carr Fork Cafion, adjoining the Utah Consolidated on the south and west, location being considered good. Property originally was the York and Copperfield groups, to which the Dana, Petro and Highland Boy Consolidated groups were added. The properties, before absorption by the present company, produced circa 300,000 tons of ore, including chalcopyritc and lead carbonates and sulphides. Lands show limestone and quartzite, carrying the Parnell, Petro, York and Andy bedded deposits, 3 of which are more or less developed, these being traversed by 6 fissure veins, of which the Leonard, Louisa, York and Petro have been opened, and proven to carry ore, the Dana fissure, which is the widest, being undeveloped. The property carries ore values mainly in copper, thongh with good values in lead, silver and gold, ores carrying an excess of iron, giving low smelting charges, because of the premium paid for each excess unit of iron by Utah smelters. First class copper ores carry only about 2% copper and circa $6 to $8 per ton combined gold and silver values, while second class copper ores carry about $3 per ton in combined gold and silver values. First class lead ores carry 36 to 50% lead, with gold and silver values, and second class lead ores range 7 to 14% in lead tenor, with small gold and silver values. In October, 1908, sixteen shipments returned an average of 1.67% copper, 35.69% lead, 8.44 oz. silver and 50 cents gold per ton. The mine shows considerable first class ore, and large quantities of second class ore, and ore reserved were increased largely, during 1908, being estimated, at end of year, at 154,000 tons of silver-lead ore, of $17 average value per ton. Development is by 3 shafts and 6 tunnels, with circa 5 miles of workings. The 6 tunnels are known as the Parnell, Minnie, Smilax, Andy, Andy No. 2 and Parvenu, each circa 200' apart vertically, and connected by incline shafts, all on the Parnell vein, which is estimated, by the company, to average 5' in width, and to be mineralized for about 1,000' on its strike and 2,000' on its dip. The tunnels are connected by incline blind shafts, of 200' and 300', equipped with electric hoists. The Andy tunnel opens 3 ore chutes on the Parnell vein. The Parvenu tunnel, which is the principal opening, is circa 3,000' in length, planned to be extended to length of nearly one mile, cutting the Parnell vein with a back of circa 2,200'. The company planned, late 1908, reducing extraction costs by connecting the Parvenu tunnel, on the 700' level, with other workings, by a 3-compartment blind shaft, to be raised 350'. A 3,000' Bleichert aerial tram runs from the portal of the Andy tunnel to a loading station, whence ore is hauled by team to the Markham mill, circa 1% miles distant. The company also has planned the construction of a 2,300' railway spur, from the mouth of the Parvenu tunnel to the Copper Belt railroad. Equipment includes a 15-drill air-compressor and 2 electric hoists, machinery plant not being extensive, owing to extraction of ore mainly through tunnels. Production, of circa 100 tons of ore daily, during 1907, was discontinued, Oct. 1, 1907, returns to that date being $220,419.13, the laut 18 shipments of 1907, of circa 25 tons each, giving average returns of about $18 per ton. Production was resumed, Aug. 15, 1908, with shipments of about 30 tons daily, increased later to 40 or 50 tons daily. Property considered decidedly promising.

A stock certificate is issued by businesses, usually companies. A stock is part of the permanent finance of a business. Normally, they are never repaid, and the investor can recover his/her money only by selling to another investor. Most stocks, or also called shares, earn dividends, at the business's discretion, depending on how well it has traded. A stockholder or shareholder is a part-owner of the business that issued the stock certificates.

Ebay ID: labarre_galleries