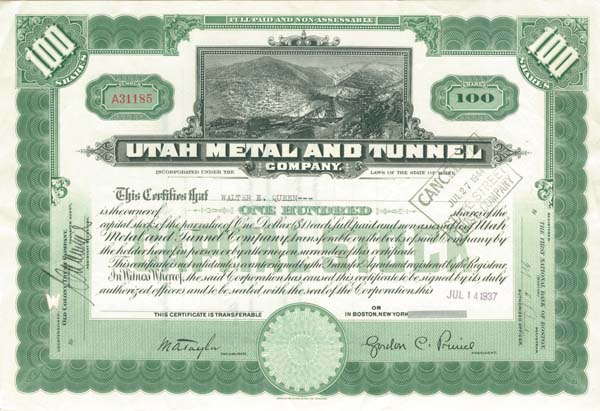

Utah Metal and Tunnel Co. - Stock Certificate

Inv# MS1313 Stock

Utah

The company is a reorganization the Utah Metal Mining. They owned 4000 acres that crossed from the Bingham district to the Tooele district in Tooele County. In the 1920’s, a large bulk of the property was leased to the Utah Delaware Mining Co. There was a 450 ton mill. The company had impressive ore productions with a peak year in 1915 with 9 million pounds of lead, 2.8 million pounds of copper, 16,000 ounces of gold and 475,000 ounces of silver. In 1929, production were 3.6 million pounds of lead, 365,000 pounds of copper, 2,500 ounces of gold and 115,000 ounces of silver. The future for the company looked bright in 1930. (Mines Handbook, 1931, p.1915-1917) UTAH METAL AND TUNNEL CO. UTAH Office: McCornick Bldg., Salt Lake City, Utah. Officers: Jas. E. Rothwell, v. p.; W. E. I.. Dillaway, sec.-treas., 45 Milk St., Boston, Mass.; Walter B. Farmer, L. E. Stoddard, A. B. Martin, directors. Chas. H. Doolittle, m«r. Inc. May 5, 1914, in Maine. Cap., $725,000; $1 par, increased from $500,000; \ov., 1914, to purchase Bingham-New Haven C. & G^-Mng. Co.; UTAH METAL AKD TUNNEL 1183 677,717 shares issued. Debentures: $375,000 ($129,250 retired 1916), due April 1, 1919. Commonwealth Trust Co., Boston, transfer agt. State St. Trust Co., Boston, registrar. Company acquired 214,589 shares out of 228,689 issued shares, Bingham-Xew Haven C. & G. Mng. Co., by exchange of share for share. Latter company has been paying dividends since 1906, with $285,861 paid in 1915, and a total of $960,493. Utah Metal has never paid dividends. Listed on Boston Curb; traded in on New York Curb. Stock sold at $1 to $10.50 in 1915. Income of Utah Metal from Sept. 25, 1914, to Dec. 31, 1915, was $383,637 and net profit carried to surplus, $180,465. The two companies earned $510,094 in 1915, excluding 5%, or $69,200 set off for depreciation. For first quarter of 1916, the combined gross income of both companies was $678,172 for ore arid $11,944 for water, and combined net earnings were $367,527. Company purchased $129,250 of its bonds, and had cash on hand and due for ore sold, $961,827. In first 6 months of 1916 net earnings were over $600,000. Company is a reorganization of the L'tah Metal Mining Co., itself a consolidation of the Bingham Central, Bingham Standard and Bingham Metal Mining Co. Property: is extensive, covering 3,539 acres, including 139 acres timber land, in Bingham district, adjoining holdings of Utah Cons, and Utah Copper Co. (Boston Con.) and extending across the range to Middle Canyon, on the Tooele side. The company's active asset is a transportation and drainage tunnel, cut 11,500' through and 2,300' below the crest of the range, from near Tooele to 'Bingham Canyon (Carr Fork). This gives direct short transportation to Tooele and Garfield and develops a large flow—600,000 gals, per day—of water sold to the Garfield mill of the Utah Copper Co. The Bingham or Carr Fork holdings include the Bingham Central & Bingham Standard groups, an area in which the various mineral bearing limestone beds of the camp are cut by the Saginaw-Burning Moscow and Xast veins, and crossed by the Old Jordan fault. The claims on the Tooele side show similar limestones, cut by fissures, but the development work there has not thus far shown commercial orebodies, as it has on the Binghanx side. In Nov., 1914. the company started crosscut exploration from the big drainage tunnel at 8,200' from the Tooele portal. In March. 1915, 1,300' from the Bingham portal, the latter work encountered mineralized ground, and on upraising 70', an orebody 25' thick was cut. Drifting disclosed a second orebody E. of and above the first, and later a third orebody, already opened and mined by the Bingham Xew Haven Co., was cut. At present there are five productive orebodies on the combined properties. One copper ore shoot 300' below the B. X. IT. tunnel has been proven for over 200'. By purchasing control of the Bingham New Haven company, the two properties can be developed togethe^r, each mining its own ground from tunnel on the other's claims. It also gives the Utah Metal much needed tramway facilities saving 60c per ton on ore shipments, and the use of the B. N. H. mill. The Bingham Xew Haven property is described under its own title, although the company is now a subsidiary of Utah Metal. Development: on Utah Metal includes besides the 11,490' transportation and drainage tunnel, and the workings therefrom, extensive tunnel development on the Bingham Central and Standard group, embracing the 700' Saginaw, 2,000' Whiteley, 2,000' Jeff Davis, 400' Deem, 950 Mtn. Maid, the Amelia and lesser tunnels, all showing ore at various points. On the Tooele side, the Middle Canyon group has one 5,000' tunnel, another 1,700' and a third 500' long. The transportation tunnel is 8'x9' in the clear, double tracked, with a half % grade. It develops the mineral bearing limestone and veins at depths of. 375 to 900' below any other workings. Production: in 1915— Gold Silver Lead Copper Oz. Oz. Lbs. Lbs. Utah Metal (7 mo.) 10,297 150,446 4,956,183 299,554 B. N. H. (12 mo.) 6,617 325,448 4,903,906 2,574,261 U. M. received 13.12 and B. N. H. 16.505c per Ib. for copper, and U. M. 3.49c per Ib. for lead, compared with 3.957c received by B. N. H. U. M. ore averaged $18.242 per ton and B. N. H. $11.975 per ton. In January, 1916, B. X. H. produced 704,155 Ibs. lead and 348,0% Ibs. copper, at an estimated prorit of $103,824. The U. M. made a profit of about $45,000, a cave-in at-the copper stope having curtailed production for the month. Company now has ample surplus for working capital, good mine equipment, a mill handling 225 tons ore daily, and should with proper development, be able to pay dividends for some years to come.

A stock certificate is issued by businesses, usually companies. A stock is part of the permanent finance of a business. Normally, they are never repaid, and the investor can recover his/her money only by selling to another investor. Most stocks, or also called shares, earn dividends, at the business's discretion, depending on how well it has traded. A stockholder or shareholder is a part-owner of the business that issued the stock certificates.

Ebay ID: labarre_galleries