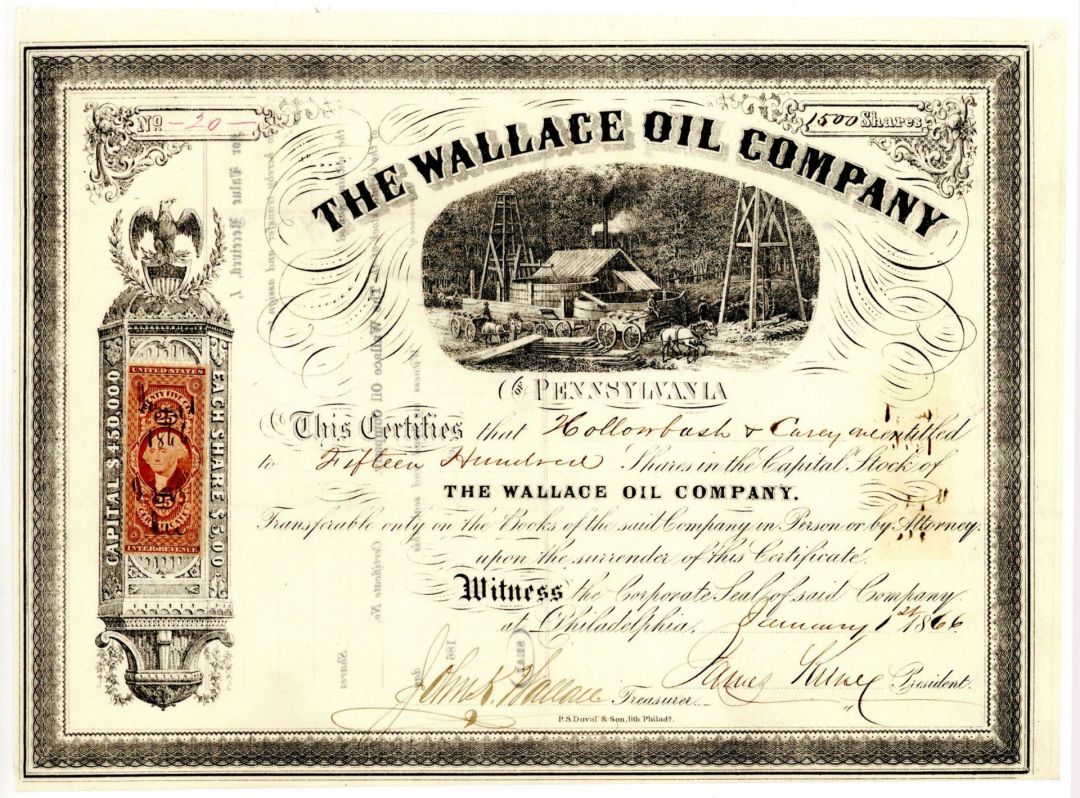

Wallace Oil Co. - 1866 dated Pennsylvania Stock Certificate

Inv# OS2118 StockStock printed by P.S. Duval & Son, lith Philad with 25 cents revenue stamp! Civil War era dated! 1,500 shares! Uncancelled and not negotiable.

In 1859, Edwin L. Drake made a groundbreaking achievement by drilling the first oil well in the United States along a creek in Titusville, Pennsylvania. This pivotal moment not only altered the landscape of the Allegheny River valley but also reshaped the future of energy in America. Drake, a former railroad conductor, ignited an industry as investors and drillers flocked to exploit this new resource for kerosene production. This rush initiated the nation’s inaugural petroleum exploration boom. Newspapers began to report on oil discoveries in the farms of Northwestern Pennsylvania’s “oil region.” Newly formed oil companies hastily erected wooden derricks equipped with steam-powered cable tools to facilitate drilling. Drillers arrived at various farms, including John Rynd’s property at the confluence of Oil Creek and Cherry Tree Run, as well as the Blood farm to the north and the widow McClintock farm to the south. John Wallace, an Irish immigrant operating a grocery store on the Rynd farm in 1859, experienced the fervor of this new industry firsthand. By 1861, when the first successful well was drilled on the Rynd farm, the hillsides were already dotted with derricks. Four years later, the ambitious 24-year-old entrepreneur succumbed to the allure of the oil boom. At that time, the field of petroleum geology was still in its infancy, and methods such as “creekology” and oil seeps were often the primary means of identifying potential drilling sites. Some exploration companies even resorted to dowsing, using hazel or peach tree rods to locate oil. Wallace secured a 3/32 royalty interest in a 200-acre parcel of the adjacent McClintock farm, which had previously been owned by investors Curtiss, Haldeman, and Fawcett.

Wallace Oil Company was established in 1865, with its office located at 319 Walnut Street in Philadelphia, where it began issuing stock certificates. Although there is no documentation indicating that the company engaged in drilling or successfully completing any wells, Wallace's speculative trading of leases, supported by his 3/32 royalty income, along with vigorous stock sales, generated revenue for the company. Investors in Wallace's stock had the potential to benefit from both royalties and stock appreciation, creating an optimistic financial outlook. In 1865, the price of a 42-gallon barrel of oil was $6.59 (equivalent to nearly $100 in 2013). The excitement surrounding oil exploration led to increased drilling activities, particularly following discoveries at Pithole Creek and other oilfields, which fueled speculation at oil exchanges in Titusville, Oil City, and beyond. Among those pursuing oil wealth in 1864 was John Wilkes Booth, whose Dramatic Oil Company operated on a 3.5-acre lease on the Fuller farm. By the end of 1869, the McClintock farm leases held by Wallace Oil Company were still yielding an average of 200 barrels of oil per day from 32 wells. It was not until three years later that the company distributed its first and only dividend to shareholders, amounting to one cent per share in 1874. However, by that time, one industry publication remarked that “oil had left the territory.” The company consistently paid an annual “Tax on Stock” to the state and, in 1871, made its first payment of a “Tax on Income.” A stereograph from around 1875, preserved in the Library of Congress, depicts a small building adorned with signs for the “Wallace Oil Company,” the “Allegheny & Pittsburgh Oil Co.,” the “Oil Basin Petroleum Co.,” the “Buchanan Royalty Oil Co.,” and the “Rouseville Oil Co.” Notably, Rouseville had experienced a tragic oil well fire in 1861, marking one of the earliest fatal incidents in the U.S. petroleum industry. By the early 1890s, the expanded holdings of Wallace Oil Company in the oil region had dwindled to the original 3/32 royalty from its McClintock property, which was no longer yielding commercially viable quantities of oil due to overproduction that had diminished profitability in the area.

A stock certificate is issued by businesses, usually companies. A stock is part of the permanent finance of a business. Normally, they are never repaid, and the investor can recover his/her money only by selling to another investor. Most stocks, or also called shares, earn dividends, at the business's discretion, depending on how well it has traded. A stockholder or shareholder is a part-owner of the business that issued the stock certificates.

Ebay ID: labarre_galleries