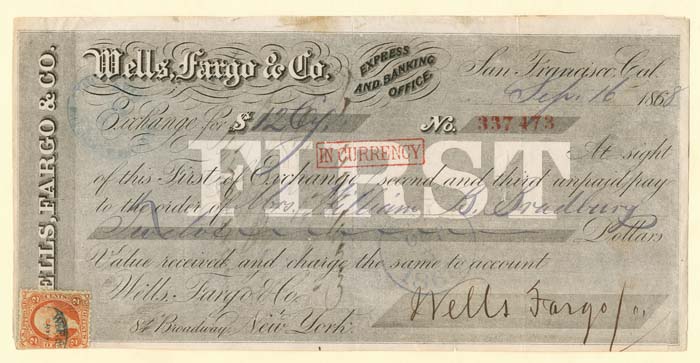

Wells, Fargo and Co. - Exchange Receipt

Inv# AX1027 Check

Exchange Receipt. San Francisco, California.

Wells Fargo & Company is an American multinational financial services company with corporate headquarters in San Francisco, California, operational headquarters in Manhattan, and managerial offices throughout the United States and overseas. The firm's primary subsidiary is national bank Wells Fargo Bank, N.A., which is incorporated in Delaware and designates its main office as Sioux Falls, South Dakota. It is the fourth largest bank in the US by total assets. Wells Fargo is ranked number 26 on the 2018 Fortune 500 rankings of the largest US corporations by total revenue.

In July 2015, Wells Fargo became the world's largest bank by market capitalization, edging past ICBC, before slipping behind JPMorgan Chase in September 2016, in the wake of a scandal involving the creation of over 2 million fake bank accounts and illegal manipulation of other accounts by Wells Fargo employees. Wells Fargo fell behind Bank of America to third by bank deposits in 2017 and behind Citigroup to fourth by total assets in 2018.

Wells Fargo in its present form is a result of a merger between San Francisco–based Wells Fargo & Company and Minneapolis-based Norwest Corporation in 1998 and the subsequent 2008 acquisition of Charlotte-based Wachovia. Following the mergers, the company transferred its headquarters to Wells Fargo's headquarters in San Francisco and merged its operating subsidiary with Wells Fargo's operating subsidiary in Sioux Falls. Along with JPMorgan Chase, Bank of America, and Citigroup, Wells Fargo is one of the "Big Four Banks" of the United States. As of June 2018, it had 8,050 branches and 13,000 ATMs. In 2018 the company had operations in 35 countries with over 70 million customers globally.

In February 2014, Wells Fargo was named the world's most valuable bank brand for the second consecutive year in The Banker and Brand Finance study of the top 500 banking brands. In 2016, Wells Fargo ranked 7th on the Forbes Global 2000 list of largest public companies in the world and ranked 27th on the Fortune 500 list of the largest companies in the US. In 2015, the company was ranked the 22nd most admired company in the world, and the 7th most respected company in the world. As of December 2018, the company had a Standard & Poors credit rating of A−. However, for a brief period in 2007, the company was the only AAA-rated bank, reflecting the highest credit rating from two firms.

On February 2, 2018, the US Federal Reserve Bank barred Wells Fargo from growing its nearly US$2 trillion-asset base any further, based upon years of misconduct, until Wells Fargo fixes its internal problems to the satisfaction of the Federal Reserve. In April 2018, The Wall Street Journal reported that the US Department of Labor had launched a probe into whether Wells Fargo was pushing its customers into more expensive retirement plans as well as into retirement funds managed by Wells Fargo itself. Subsequently in May 2018, The Wall Street Journal reported that Wells Fargo's business banking group had improperly altered documents about business clients in 2017 and early 2018. In June 2018, Wells Fargo began retreating from retail banking in the Midwestern United States by announcing the sale of all its physical bank branch locations in Indiana, Michigan, and Ohio to Flagstar Bank.

The company operates 12 museums, most known as a Wells Fargo History Museum, in its corporate buildings in Charlotte, North Carolina; Denver, Colorado; Des Moines, Iowa; Los Angeles, California; Minneapolis, Minnesota; Philadelphia, Pennsylvania; Phoenix, Arizona; Portland, Oregon; Sacramento, California; and San Francisco, California. Displays include original stagecoaches, photographs, gold nuggets and mining artifacts, the Pony Express, telegraph equipment, and historic bank artifacts. The company also operates a museum about company history in the Pony Express Terminal in Old Sacramento State Historic Park in Sacramento, California, which was the company's second office, and the Wells Fargo History Museum in Old Town San Diego State Historic Park in San Diego, California.

Wells Fargo operates the Alaska Heritage Museum in Anchorage, Alaska, which features a large collection of Alaskan Native artifacts, ivory carvings and baskets, fine art by Alaskan artists, and displays about Wells Fargo history in the Alaskan Gold Rush era.

- 1852: Henry Wells and William G. Fargo, the two founders of American Express, formed Wells Fargo & Company to provide express and banking services to California.

- 1860: Wells Fargo gained control of Butterfield Overland Mail Company, leading to operation of the western portion of the Pony Express.

- 1866: "Grand consolidation" united Wells Fargo, Holladay, and Overland Mail stage lines under the Wells Fargo name.

- 1872: Lloyd Tevis, a friend of the Central Pacific "Big Four" and holder of rights to operate an express service over the Transcontinental Railroad, acquires control of the company.

- 1905: Wells Fargo separated its banking and express operations; Wells Fargo's bank was merged with the Nevada National Bank to form the Wells Fargo Nevada National Bank.

- 1918: As a wartime measure, the US Federal Government nationalized Wells Fargo's express franchise into a federal agency known as the US Railway Express Agency. The US Federal Government took control of the express company. The bank began rebuilding but with a focus on commercial markets. After the war, REA was privatized and continued service until 1975.

- 1923: Wells Fargo Nevada merged with the Union Trust Company to form the Wells Fargo Bank & Union Trust Company.

- 1929: Northwest Bancorporation was formed as a banking association.

- 1954: Wells Fargo & Union Trust shortened its name to Wells Fargo Bank.

- 1960: Wells Fargo merged with American Trust Company to form the Wells Fargo Bank American Trust Company.

- 1962: Wells Fargo American Trust shortened its name to Wells Fargo Bank.

- 1968: Wells Fargo converted to a federal banking charter, becoming Wells Fargo Bank, N.A. Wells Fargo merged with Henry Trione's Sonoma Mortgage in a $10.8 million stock transfer, making Trione the largest shareholder in Wells Fargo until Warren Buffett and Walter Annenberg later surpassed him.

- 1969: Wells Fargo & Company holding company was formed, with Wells Fargo Bank as its main subsidiary.

- 1982: Northwest Bancorporation acquired consumer finance firm Dial Finance which is renamed Norwest Financial Service the following year.

- 1983: Northwest Bancorporation was renamed Norwest Corporation.

- 1983: White Eagle, largest US bank heist to date took place at a Wells Fargo depot in West Hartford, Connecticut.

- 1986: Wells Fargo acquired Crocker National Corporation from Midland Bank.

- 1987: Wells Fargo acquired the personal trust business of Bank of America.

- 1988: Wells Fargo acquired Barclays Bank of California from Barclays plc.

- 1991: Wells Fargo acquired 130 California branches from Great American Bank for $491 million.

- 1995: Wells Fargo became the first major US financial services firm to offer Internet banking.

- 1996: Wells Fargo acquired First Interstate Bancorp for US$11.6 billion.

- 1998: Wells Fargo Bank was acquired by Norwest Corporation of Minneapolis. (Norwest was the surviving company; however, it chose to continue business under the more well-known Wells Fargo name.)

- 2000: Wells Fargo Bank acquired National Bank of Alaska.

- 2000: Wells Fargo acquired First Security Corporation.

- 2001: Wells Fargo acquired H.D. Vest Financial Services for US$128 million (US$188 million for inflation), but sold it in 2015 for US$580 million (US$637 million for inflation).

- 2007: Wells Fargo acquired CIT's construction unit.

- 2007: Wells Fargo acquired Placer Sierra Bank.

- 2007: Wells Fargo acquired Greater Bay Bancorp, which had US$7.4 billion in assets, in a US$1.5 billion transaction.

- 2008: Wells Fargo acquired United Bancorporation of Wyoming.

- 2008: Wells Fargo acquired Century Bancshares of Texas.

- 2008: Wells Fargo acquired Wachovia Corporation.

- 2009: Wells Fargo acquired North Coast Surety Insurance Services.

- 2012: Wells Fargo acquired Merlin Securities.

- 2012: Wells Fargo acquired stake in The Rock Creek Group LP.

- 2019: CEO Tim Sloan resigns causing stock to jump and leaves General Counsel C. Allen Parker as Interim CEO. On September 27, Charles Scharf is announced as the firm's new CEO.

On October 3, 2008, Wachovia agreed to be bought by Wells Fargo for about US$14.8 billion in an all-stock transaction. This news came four days after the US Federal Deposit Insurance Corporation (FDIC) made moves to have Citigroup buy Wachovia for US$2.1 billion. Citigroup protested Wachovia's agreement to sell itself to Wells Fargo and threatened legal action over the matter. However, the deal with Wells Fargo overwhelmingly won shareholder approval since it valued Wachovia at about seven times what Citigroup offered. To further ensure shareholder approval, Wachovia issued Wells Fargo preferred stock that holds 39.9% of the voting power in the company.

On October 4, 2008, a New York state judge issued a temporary injunction blocking the transaction from going forward while the situation was sorted out. Citigroup alleged that they had an exclusivity agreement with Wachovia that barred Wachovia from negotiating with other potential buyers. The injunction was overturned late in the evening on October 5, 2008, by New York state appeals court. Citigroup and Wells Fargo then entered into negotiations brokered by the FDIC to reach an amicable solution to the impasse. Those negotiations failed. Sources say that Citigroup was unwilling to take on more risk than the US$42 billion that would have been the cap under the previous FDIC-backed deal (with the FDIC incurring all losses over US$42 billion). Citigroup did not block the merger, but indicated they would seek damages of US$60 billion for breach of an alleged exclusivity agreement with Wachovia.

On October 28, 2008, Wells Fargo was the recipient of US$25 billion of Emergency Economic Stabilization Act funds in the form of a preferred stock purchase by the US Treasury Department. Tests by the US Federal Government revealed that Wells Fargo needed an additional US$13.7 billion in order to remain well-capitalized if the economy were to deteriorate further under stress test scenarios. On May 11, 2009, Wells Fargo announced an additional stock offering which was completed on May 13, 2009, raising US$8.6 billion in capital. The remaining US$4.9 billion in capital was planned to be raised through earnings. On Dec. 23, 2009, Wells Fargo redeemed US$25 billion of preferred stock issued to the US Treasury. As part of the redemption of the preferred stock, Wells Fargo also paid accrued dividends of US$131.9 million, bringing the total dividends paid to US$1.441 billion since the preferred stock was issued in October 2008.

Wells Fargo Securities was established in 2009 to house Wells Fargo's capital markets group which it obtained during the Wachovia acquisition. Prior to that point, Wells Fargo had little to no participation in investment banking activities, though Wachovia had a well-established investment banking practice which it operated under the Wachovia Securities banner.

Wachovia's institutional capital markets and investment banking business arose from the merger of Wachovia and First Union. First Union had bought Bowles Hollowell Connor & Co. on April 30, 1998 adding to its merger and acquisition, high yield, leveraged finance, equity underwriting, private placement, loan syndication, risk management, and public finance capabilities.

Legacy components of Wells Fargo Securities include Wachovia Securities, Bowles Hollowell Connor & Co., Barrington Associates, Halsey, Stuart & Co., Leopold Cahn & Co., Bache & Co.. Prudential Securities, A.G. Edwards, Inc. and the investment banking arm of Citadel LLC.

In 2009, Wells Fargo ranked #1 among banks and insurance companies, and #13 overall, in Newsweek Magazine's inaugural "Green Rankings" of the country's 500 largest companies. In 2013, the company was recognized by the EPA Center for Corporate Climate Leadership as a Climate Leadership Award winner, in the category "Excellence in Greenhouse Gas Management (Goal Setting Certificate)"; this recognition was for the company's aim to reduce its absolute greenhouse gas emissions from its US operations by 35% by 2020 versus 2008 levels.

As of 2013, Wells Fargo had provided more than US$6 billion in financing for environmentally beneficial business opportunities, including supporting 185 commercial-scale solar photovoltaic projects and 27 utility-scale wind projects nationwide.

The Community Banking segment includes Regional Banking, Diversified Products, and Consumer Deposits groups, as well as Wells Fargo Customer Connection (formerly Wells Fargo Phone Bank, Wachovia Direct Access, the National Business Banking Center, and Credit Card Customer Service). Wells Fargo also has around 2,000 stand-alone mortgage branches throughout the country. There are mini-branches located inside of other buildings, which are almost exclusively grocery stores, that usually contain ATMs, basic teller services, and, space permitting, an office for private meetings with customers. In March 2017, Wells Fargo announced a plan to offer smartphone-based transactions with mobile wallets including Wells Fargo Wallet, Android Pay and Samsung Pay.

As of Q3 2011, Wells Fargo Home Mortgage was the largest retail mortgage lender in the United States, originating one out of every four home loans. Wells Fargo services US$1.8 trillion in home mortgages, the second-largest servicing portfolio in the US It was reported in 2012 Wells Fargo reached 30% market share for US mortgages, however, the then-CEO John Stumpf had said the numbers were misleading because about half of that share represented the aggregation of smaller loans that were then sold on the secondary market. In 2013, its share was closer to 22%; of which eight percentage points was aggregation.

Private student loans are available to students to pay for college expenses, such as tuition, books, computers, or housing. Loans are available for undergraduate, career and community colleges, graduate school, law school and medical school. Wells Fargo also provides private student loan consolidation and student loans for parents.

Wells Fargo has various divisions that finance and lease equipment to different types of companies. One venture is Wells Fargo Rail, which in 2015 agreed to the purchase of GE Capital Rail Services and merged in with First Union Rail. In late 2015, it was announced that Wells Fargo would buy three GE units focused on business loans equipment financing.

Wells Fargo offers investment products through its subsidiaries, Wells Fargo Investments, LLC, and Wells Fargo Advisors, LLC, as well as through national broker/dealer firms. The company also serves high-net-worth individuals through its private bank and family wealth group.

Wells Fargo Advisors is the brokerage subsidiary of Wells Fargo, located in St. Louis, Missouri. It is the third-largest brokerage firm in the United States as of the third quarter of 2010 with US$1.1 trillion retail client assets under management.

Wells Fargo Advisors was known as Wachovia Securities until May 1, 2009, when it legally changed names following Wells Fargo's acquisition of Wachovia Corporation.

In September 2018, Wells Fargo announced it would cut 26,450 jobs by 2020 to reduce costs by US$4 billion.

In the second quarter of 2020, the company reported a net loss of $2.4 billion. However, in the third quarter, the same year, the company recorded a revenue of $18.9 billion. According to Charlie Scharf, the chief executive of the firm, "our third-quarter results reflect the impact of aggressive monetary and fiscal stimulus on the US economy. Strong mortgage banking fees, higher equity markets, and declining sequential charge-offs positively impacted our results, while historically low interest rates."

Wells Fargo Asset Management (WFAM) is the trade name for the mutual fund division of Wells Fargo & Co. Mutual funds are offered under the Wells Fargo Advantage Funds brand name.

Wells Fargo Securities (WFS) is the investment banking division of Wells Fargo & Co. The size and financial performance of this group are not disclosed publicly, but analysts believe the investment banking group houses approximately 4,500 employees and generates between US$3 and $4 billion per year in investment banking revenue. By comparison, two of Wells Fargo's largest competitors, Bank of America and J.P. Morgan Chase generated approximately US$5.5 billion and $6 billion respectively in 2011 (not including sales and trading revenue). WFS headquarters are in Charlotte, with other US offices in New York, Minneapolis, Boston, Houston, San Francisco, and Los Angeles, with international offices in London, Hong Kong, Singapore, and Tokyo.

A key part of Wells Fargo's business strategy is cross-selling, the practice of encouraging existing customers to buy additional banking services. Customers inquiring about their checking account balance may be pitched mortgage deals and mortgage holders may be pitched credit card offers in an attempt to increase the customer's profitability to the bank. Other banks have attempted to emulate Wells Fargo's cross-selling practices (described by The Wall Street Journal as a hard sell technique); Forbes magazine describes Wells Fargo as "better than anyone" at the practice.

Wells Fargo has banking services throughout the world, with offices in Hong Kong, London, Dubai, Singapore, Tokyo, and Toronto. They operate back-offices in India and the Philippines with more than 20,000 staff.

In 2010, hedge fund administrator Citco purchased the trust company operation of Wells Fargo in the Cayman Islands.

Wells Fargo operates under Charter #1, the first national bank charter issued in the United States. This charter was issued to First National Bank of Philadelphia on June 20, 1863, by the Office of the Comptroller of the Currency. Traditionally, acquiring banks assume the earliest issued charter number. Thus, the first charter passed from First National Bank of Philadelphia to Wells Fargo through its 2008 acquisition of Wachovia, which had inherited it through one of its many acquisitions.

In 1981, it was discovered that a Wells Fargo assistant operations officer, Lloyd Benjamin "Ben" Lewis, had perpetrated one of the largest embezzlements in history, through its Beverly Drive branch. During 1978 - 1981, Lewis had successfully written phony debit and credit receipts to benefit boxing promoters Harold J. Smith (né Ross Eugene Fields) and Sam "Sammie" Marshall, chairman and president, respectively, of Muhammed Ali Professional Sports, Inc. (MAPS), of which Lewis was also listed as a director; Marshall, too, was a former employee of the same Wells Fargo branch as Lewis. In excess of US$300,000 was paid to Lewis, who pled guilty to embezzlement and conspiracy charges in 1981, and testified against his co-conspirators for a reduced five-year sentence. (Boxer Muhammed Ali had received a fee for the use of his name, and had no other involvement with the organization.

Illinois Attorney General Lisa Madigan filed suit against Wells Fargo on July 31, 2009, alleging that the bank steers African Americans and Hispanics into high-cost subprime loans. A Wells Fargo spokesman responded that "The policies, systems, and controls we have in place – including in Illinois – ensure race is not a factor..." An affidavit filed in the case stated that loan officers had referred to black mortgage-seekers as "mud people," and the subprime loans as "ghetto loans." According to Beth Jacobson, a loan officer at Wells Fargo interviewed for a report in The New York Times, "We just went right after them. Wells Fargo mortgage had an emerging-markets unit that specifically targeted black churches because it figured church leaders had a lot of influence and could convince congregants to take out subprime loans." The report goes on to present data from the city of Baltimore, where "more than half the properties subject to foreclosure on a Wells Fargo loan from 2005 to 2008 now stand vacant. And 71 percent of those are in predominantly black neighborhoods." Wells Fargo agreed to pay US$125 million to subprime borrowers and US$50 million in direct down payment assistance in certain areas, for a total of US$175 million.

In a March 2010 agreement with US federal prosecutors, Wells Fargo acknowledged that between 2004 and 2007 Wachovia had failed to monitor and report suspected money laundering by narcotics traffickers, including the cash used to buy four planes that shipped a total of 22 tons of cocaine into Mexico.

In August 2010, Wells Fargo was fined by US District Court judge William Alsup for overdraft practices designed to "gouge" consumers and "profiteer" at their expense, and for misleading consumers about how the bank processed transactions and assessed overdraft fees.

On February 9, 2012, it was announced that the five largest mortgage servicers (Ally Financial, Bank of America, Citi, JPMorgan Chase, and Wells Fargo) agreed to a settlement with the US Federal Government and 49 states. The settlement, known as the National Mortgage Settlement (NMS), required the servicers to provide about US$26 billion in relief to distressed homeowners and in direct payments to the federal and state governments. This settlement amount makes the NMS the second largest civil settlement in US history, only trailing the Tobacco Master Settlement Agreement. The five banks were also required to comply with 305 new mortgage servicing standards. Oklahoma held out and agreed to settle with the banks separately.

On April 5, 2012, a federal judge ordered Wells Fargo to pay US$3.1 million in punitive damages over a single loan, one of the largest fines for a bank ever for mortgaging service misconduct. Elizabeth Magner, a federal bankruptcy judge in the Eastern District of Louisiana, cited the bank's behavior as "highly reprehensible", stating that Wells Fargo has taken advantage of borrowers who rely on the bank's accurate calculations. She went on to add, "perhaps more disturbing is Wells Fargo's refusal to voluntarily correct its errors. It prefers to rely on the ignorance of borrowers or their inability to fund a challenge to its demands, rather than voluntarily relinquish gains obtained through improper accounting methods."

On August 14, 2012, Wells Fargo agreed to pay around US$6.5 million to settle US Securities and Exchange Commission (SEC) charges that in 2007 it sold risky mortgage-backed securities without fully realizing their dangers.

On October 9, 2012, the US Federal Government sued the bank under the False Claims Act at the federal court in Manhattan, New York. The suit alleges that Wells Fargo defrauded the US Federal Housing Administration (FHA) over the past ten years, underwriting over 100,000 FHA backed loans when over half did not qualify for the program. This suit is the third allegation levied against Wells Fargo in 2012.

In October 2012, Wells Fargo was sued by United States Attorney Preet Bharara over questionable mortgage deals.

In April 2013, Wells Fargo settled a suit with 24,000 Florida homeowners alongside insurer QBE, in which Wells Fargo was accused of inflating premiums on forced-place insurance.

In May 2013, Wells Fargo paid US$203 million to settle class-action litigation accusing the bank of imposing excessive overdraft fees on checking-account customers. Also in May, the New York attorney-general, Eric Schneiderman, announced a lawsuit against Wells Fargo over alleged violations of the national mortgage settlement, a US$25 billion deal struck between 49 state attorneys and the five largest mortgage servicers in the US. Schneidermann claimed Wells Fargo had violated rules over giving fair and timely serving.

In February 2015, Wells Fargo agreed to pay US$4 million for violations where an affiliate took interest in the homes of borrowers in exchange for opening credit card accounts for the homeowners. This is illegal according to New York credit card laws. There was a US$2 million penalty with the other US$2 million going towards restitution to customers.

With CEO John Stumpf being paid 473 times more than the median employee, Wells Fargo ranks number 33 among the S&P 500 companies for CEO—employee pay inequality. In October 2014, a Wells Fargo employee earning US$15 per hour emailed the CEO—copying 200,000 other employees—asking that all employees be given a US$10,000 per year raise taken from a portion of annual corporate profits to address wage stagnation and income inequality. After being contacted by the media, Wells Fargo responded that all employees receive "market competitive" pay and benefits significantly above US federal minimums.

In December 2011, the non-partisan organization Public Campaign criticized Wells Fargo for spending US$11 million on lobbying and not paying any taxes during 2008–2010, instead getting US$681 million in tax rebates, despite making a profit of US$49 billion, laying off 6,385 workers since 2008, and increasing executive pay by 180% to US$49.8 million in 2010 for its top five executives. As of 2014 however, at an effective tax rate of 31.2% of its income, Wells Fargo is the fourth-largest payer of corporation tax in the US.

The GEO Group, Inc., a multi-national provider of for-profit private prisons, received investments made by Wells Fargo mutual funds on behalf of clients, not investments made by Wells Fargo and Company, according to company statements. By March 2012, its stake had grown to more than 4.4 million shares worth US$86.7 million. As of November 2012, the latest SEC filings reveal that Wells Fargo has divested 33% of its dispositive holdings of GEO's stock, which reduces Wells Fargo's holdings to 4.98% of Geo Group's common stock. By reducing its holdings to less than 5%, Wells Fargo will no longer be required to disclose some financial dealings with GEO.

While a coalition of organizations, National People's Action Campaign, has seen some success in pressuring Wells Fargo to divest from private prison companies like GEO Group, the company continues to make such investments.

In 2015, an analyst at Wells Fargo settled an insider trading case with the US Securities and Exchange Commission (SEC). The former employee was charged with insider trading alongside an ex-Wells Fargo trader. Sadis & Goldberg obtained a settlement that permitted the client to continue in securities industry, while neither admitting nor denying one charge of negligence-based § 17(a)(3) claim, and paying a US$75,000 civil penalty

In September 2016, Wells Fargo was issued a combined total of US$185 million in fines for opening over 1.5 million checking and savings accounts and 500,000 credit cards on behalf of their customers, without their consent. The US Consumer Financial Protection Bureau issued US$100 million in fines, the largest in the agency's five-year history, along with US$50 million in fines from the City and County of Los Angeles, and US$35 million in fines from the Office of Comptroller of the Currency. The scandal was caused by an incentive-compensation program for employees to create new accounts. It led to the firing of nearly 5,300 employees and US$5 million being set aside for customer refunds on fees for accounts the customers never wanted. Carrie Tolstedt, who headed the department, retired in July 2016 and received US$124.6 million in stock, options, and restricted Wells Fargo shares as a retirement package. On October 12, 2016, John Stumpf, the then Chairman and CEO, announced that he would be retiring amidst the controversies involving his company. It was announced by Wells Fargo that President and Chief Operating Officer Timothy J. Sloan would succeed, effective immediately. Following the scandal, applications for credit cards and checking accounts at the bank plummeted. In response to the event, the Better Business Bureau dropped accreditation of the bank, S&P Global Ratings lowered its outlook for Wells Fargo from stable to negative, and several states and cities across the US ended business relations with the company. An investigation by the Wells Fargo board of directors, the report of which was released in April 2017, primarily blamed Stumpf, whom it said had not responded to evidence of wrongdoing in the consumer services division, and Tolstedt, who was said to have knowingly set impossible sales goals and refused to respond when subordinates disagreed with them. The board chose to use a clawback clause in the retirement contracts of Stumpf and Tolstedt to recover US$75 million worth of cash and stock from the former executives.

Wells Fargo reached a settlement with the United States Department of Justice and the Securities and Exchange Commission in February 2020. The settlement, which included a US$3 billion fine for the bank's violations of criminal and civil law, does not prevent individual employees from being targets of future litigation. Despite the 2020 stock market crash, Wells Fargo had to sell assets worth over $100 million in order to avoid future problems with the Federal Reserve. Previously, the Reserve had put a limit to Wells Fargo's access to funds, as a result of the scandal.

In November 2016, Wells Fargo agreed to pay US$50 million to settle a racketeering lawsuit in which the bank was accused of overcharging hundreds of thousands of homeowners for appraisals ordered after they defaulted on their mortgage loans. While banks are allowed to charge homeowners for such appraisals, Wells Fargo frequently charged homeowners US$95 to US$125 on appraisals for which the bank had been charged US$50 or less. The plaintiffs had sought triple damages under the U.S. Racketeer Influenced and Corrupt Organizations Act on grounds that sending invoices and statements with fraudulently concealed fees constituted mail and wire fraud sufficient to allege racketeering.

Wells Fargo is a lender on the Dakota Access Pipeline, a 1,172-mile-long (1,886 km) underground oil pipeline transport system in North Dakota. The pipeline has been controversial regarding its potential impact on the environment.

In February 2017, Seattle, Washington's city council unanimously voted to not renew its contract with Wells Fargo "in a move that cites the bank's role as a lender to the Dakota Access Pipeline project as well as its "creation of millions of bogus accounts." and saying the bidding process for its next banking partner will involve "social responsibility." The City Council of Davis, California, took a similar action voting unanimously to find a new bank to handle its accounts by the end of 2017.

In December 2016, the Financial Industry Regulatory Authority fined Wells Fargo US$5.5 million for failing to store electronic documents in a "write once, read many" format, which makes it impossible to alter or destroy records after they are written.

Wells Fargo is the top banker for US gun makers and the National Rifle Association (NRA). From December 2012 through February 2018 it reportedly helped two of the biggest firearms and ammunition companies obtain US$431.1 million in loans and bonds. It also created a US$28-million line of credit for the NRA and operates the organization's primary accounts.

In a March 2018 statement, Wells Fargo said, "Any solutions on how to address this epidemic will be complicated. This is why our company believes the best way to make progress on these issues is through the political and legislative process. ... We plan to engage our customers that legally manufacture firearms and other stakeholders on what we can do together to promote better gun safety for our communities." Wells Fargo's CEO subsequently said that the bank would provide its gun clients with feedback from employees and investors.

In June 2018, about a dozen female Wells Fargo executives from the wealth management division met in Scottsdale, Arizona to discuss the minimal presence of women occupying senior roles within the company. The meeting, dubbed "the meeting of 12", represented the majority of the regional managing directors, of which 12 out of 45 are women. Wells Fargo had previously been investigating reports of gender bias in the division in the months leading up to the meeting. The women reported that they had been turned down for top jobs despite their qualifications, and instead the roles were occupied by men. There were also complaints against company president Jay Welker, who is also the head of the Wells Fargo wealth management division, due to his sexist statements regarding female employees. The female workers claimed that he called them "girls" and said that they "should be at home taking care of their children."

On June 10, 2019, Wells Fargo settled a lawsuit for $385 million that was filed in 2017 concerning their customers and National General Insurance.

Pursuant to Section 953(b) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, publicly traded companies are required to disclose (1) the median total annual compensation of all employees other than the CEO and (2) the ratio of the CEO's annual total compensation to that of the median employee.

Total 2018 compensation for Timothy J. Sloan, CEO, was $18,426,734, and total compensation for the median employee was estimated to be $65,191. The resulting pay ratio was determined to be 283:1.

Ebay ID: labarre_galleries