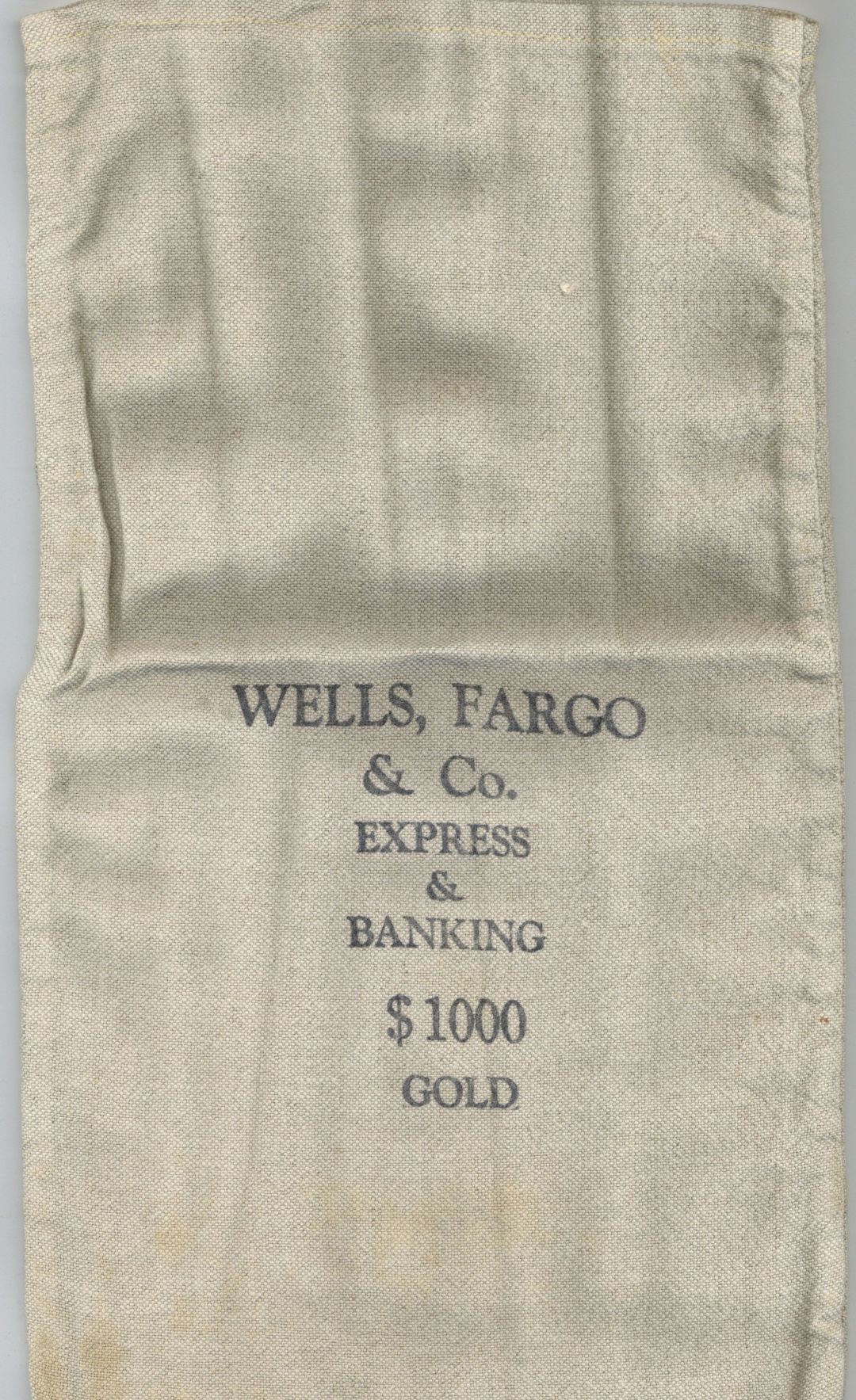

Wells, Fargo and Co. Express and Banking Money Bag - Americana

Inv# AM1754"Wells, Fargo & Co. Express & Banking $1000 Gold" burlap bag. Measures 9 3/4" x 17 1/4".

Wells Fargo & Company is an American multinational financial services company with corporate headquarters in San Francisco, California; operational headquarters in Manhattan; and managerial offices throughout the United States and internationally. The company has operations in 35 countries with over 70 million customers globally. It is considered a systemically important financial institution by the Financial Stability Board.

The firm's primary subsidiary is Wells Fargo Bank, N.A., a national bank chartered in Wilmington, Delaware, which designates its main office in Sioux Falls, South Dakota. It is the fourth largest bank in the United States by total assets and is also one of the largest as ranked by bank deposits and market capitalization. Along with JPMorgan Chase, Bank of America and Citigroup. Wells Fargo is one of the "Big Four Banks" of the United States. It has 8,050 branches and 13,000 ATMs. It is one of the most valuable bank brands.

Wells Fargo, in its present form, is a result of a merger between the original Wells Fargo & Company and Minneapolis-based Norwest Corporation in 1998. While Norwest was the nominal survivor, the merged company took the better-known Wells Fargo name and moved to Wells Fargo's hub in San Francisco. At the same time, its banking subsidiary merged with Wells Fargo's Sioux Falls-based banking subsidiary. Wells Fargo became a coast-to-coast bank with the 2008 acquisition of Charlotte-based Wachovia.

Wells Fargo is ranked 37th on the Fortune 500 list of the largest companies in the US. The company has been the subject of several investigations by regulators. On February 2, 2018, account fraud by the bank resulted in the Federal Reserve barring Wells Fargo from growing its nearly $2 trillion-asset base any further until the company fixed its internal problems to the satisfaction of the Federal Reserve. In September 2021, Wells Fargo incurred further fines from the United States Justice Department charging fraudulent behavior by the bank against foreign-exchange currency trading customers. Bloomberg Businessweek reported in March 2022 that Wells Fargo was the only major lender in 2020 to reject more home refinancing applications from Black applicants than it approved.

Ebay ID: labarre_galleries